Welcome back! It has been some time since there has been analysis on take-home pay for PGA Tour players. The hope this 2018 year is to expand the website’s presence to compare earnings at the PGA Tour level to the LPGA Tour level. There will also be some international earnings that will be analyzed, although the tax information is much harder to obtain for the various jurisdictions.

This post is Part 1 of the process that Golf Moola will use to calculate a PGA Tour and LPGA Tour player’s earnings at each week’s event. More posts on the assumptions we will use this year will be shown later this week.

First, it is important that we establish a foundation related to Federal Income Tax as the initial reduction in take-home pay of a professional golfer.

How is a PGA Tour and LPGA Tour Golfer classified as an employee?

Professional golfers are considered “self-employed individuals.” The Internal Revenue Service (IRS) defines a self-employed individual in the following way:

What Tax Return do they have to File?

If a self-employe individual earns $400 or more (e.g. every single professional golfer in America), the individual must file a Form 1040. Self-employed individuals must also file an informational return. For simplicity’s sake, a professional golfer must file a Form 1099-MISC because their income likely falls into one of the categories below. The box indicated in parentheses is where each type of dollar amount earned will be entered.

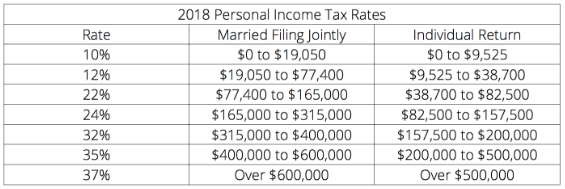

What are the Current Federal Income Tax Rates?

With the recent passage of the Tax Cuts & Jobs Act (TCJA), individuals now are subject to both new tax brackets and tax rate structure. As we all know, tax rates are progressive, meaning that as income rises, so do tax rates.

Below are the 2018 individual income tax rates: