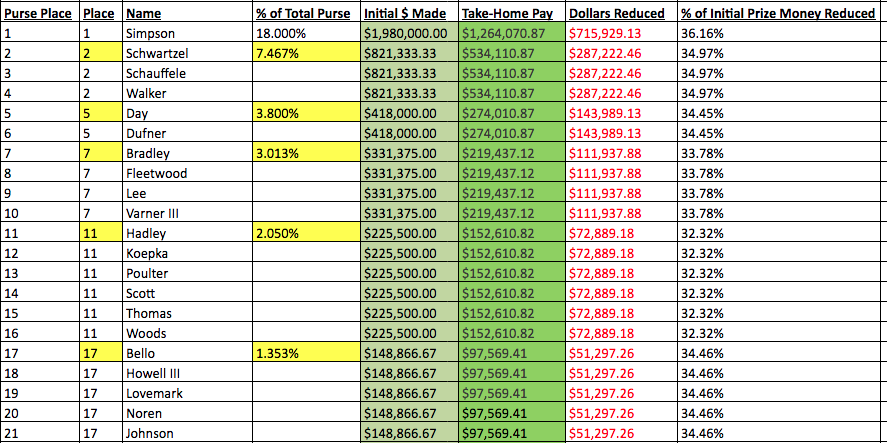

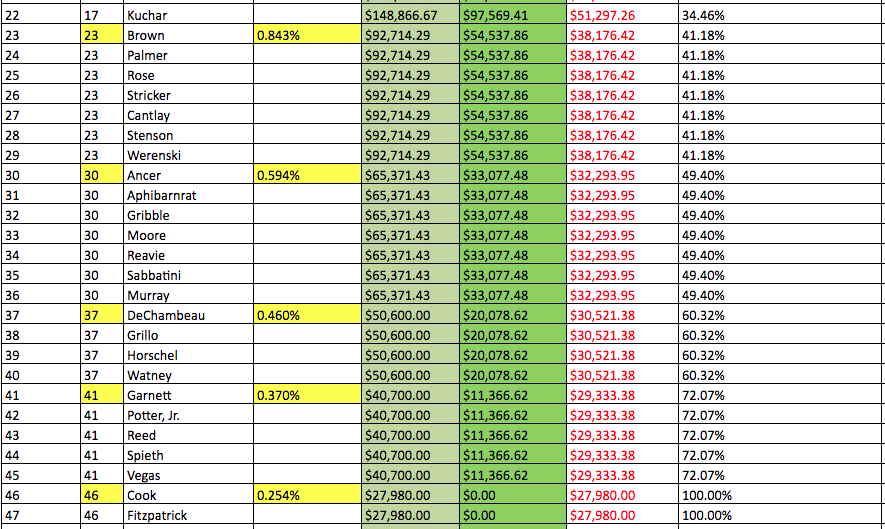

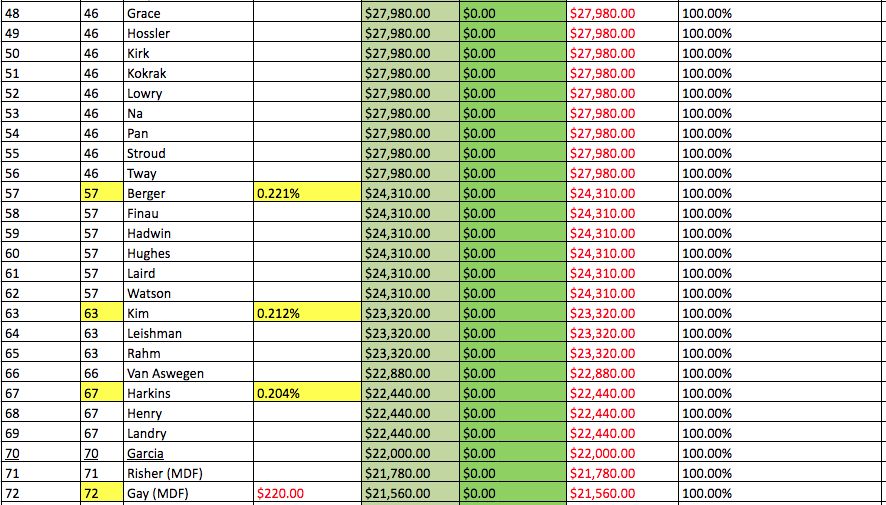

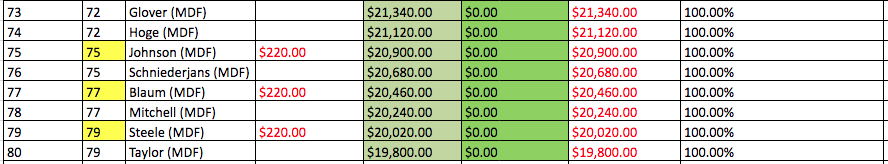

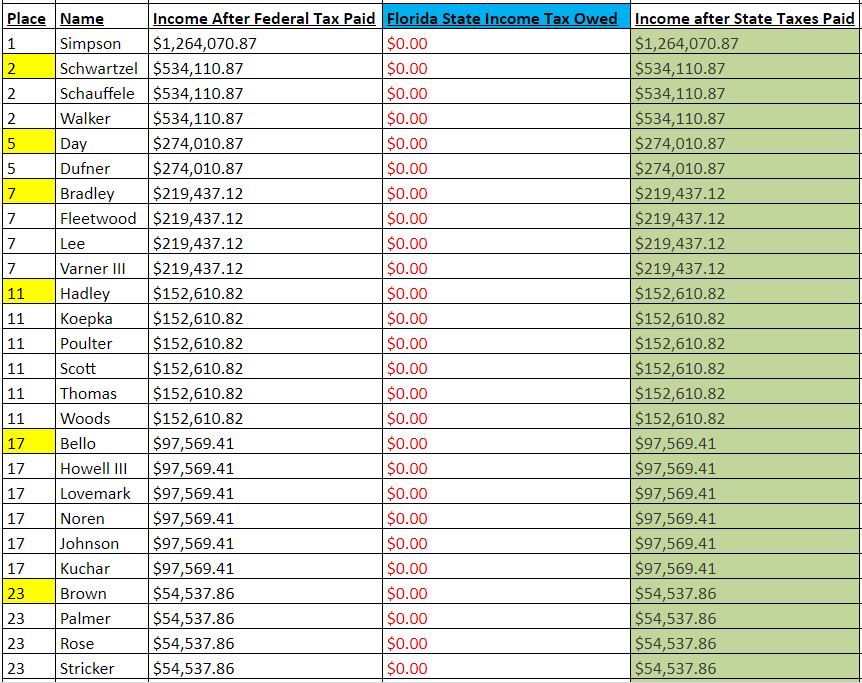

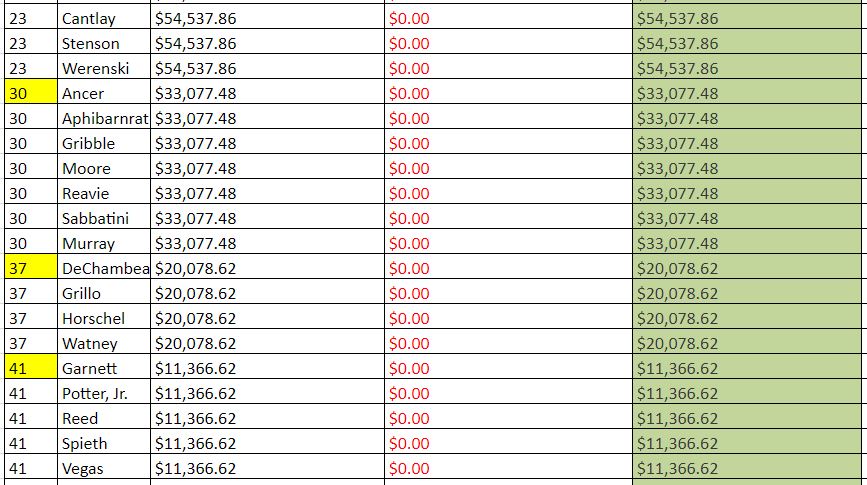

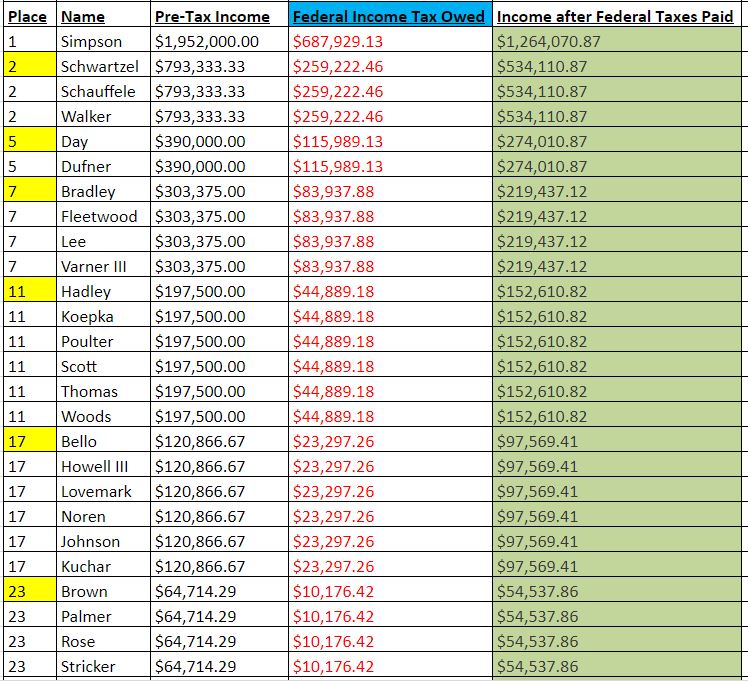

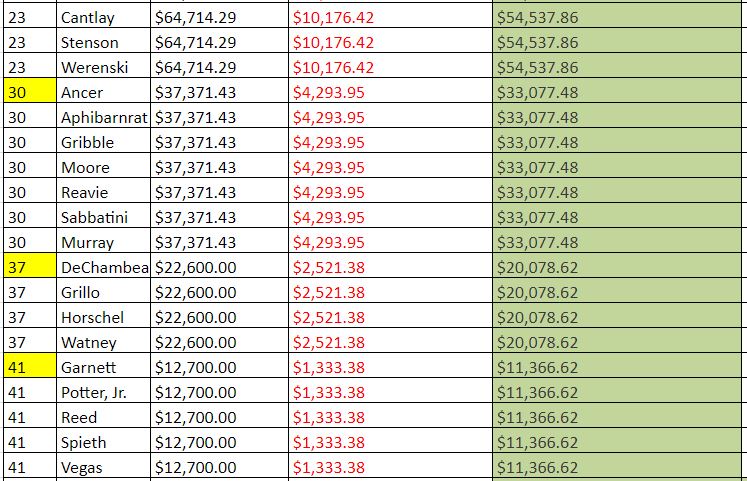

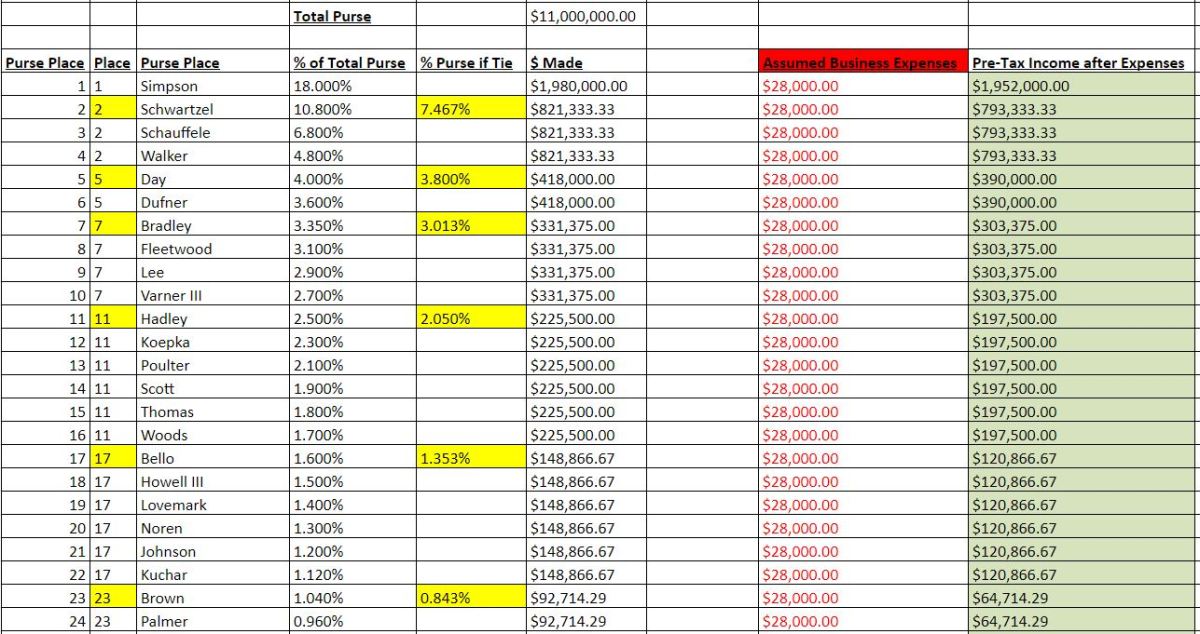

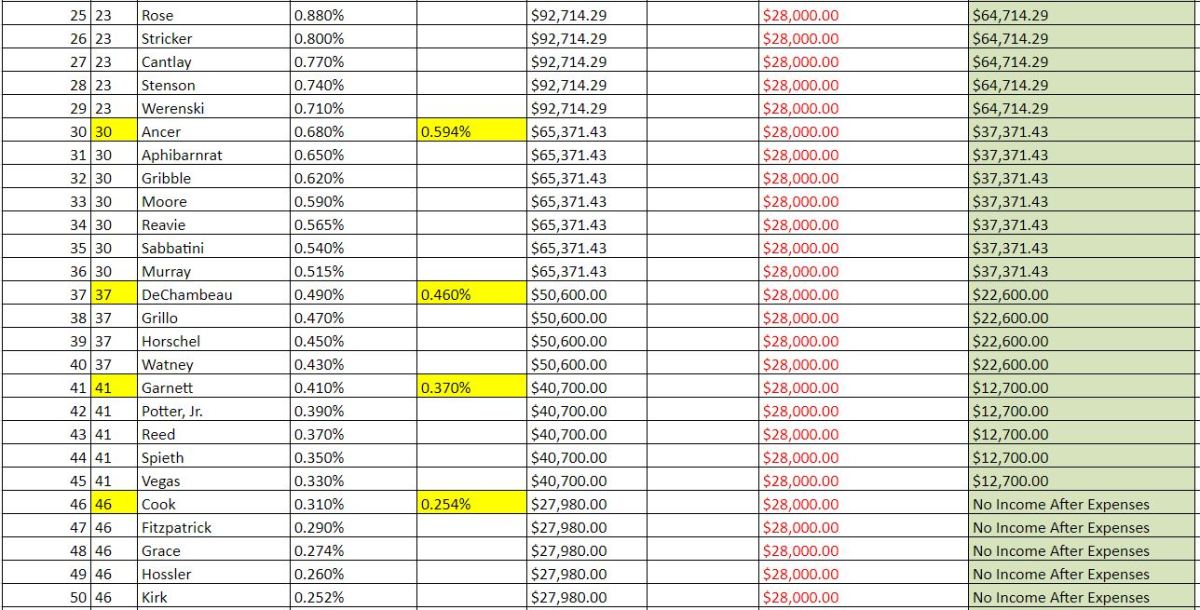

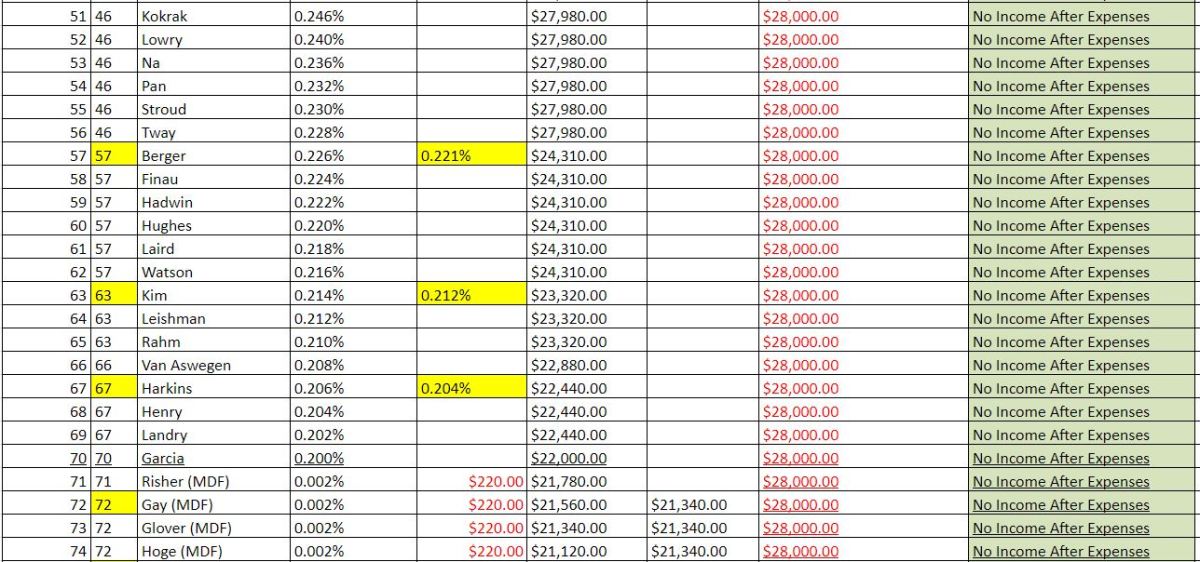

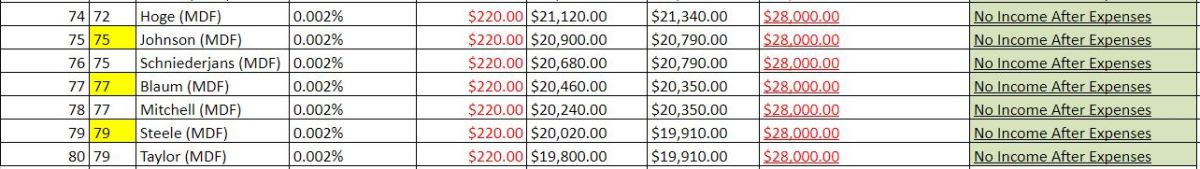

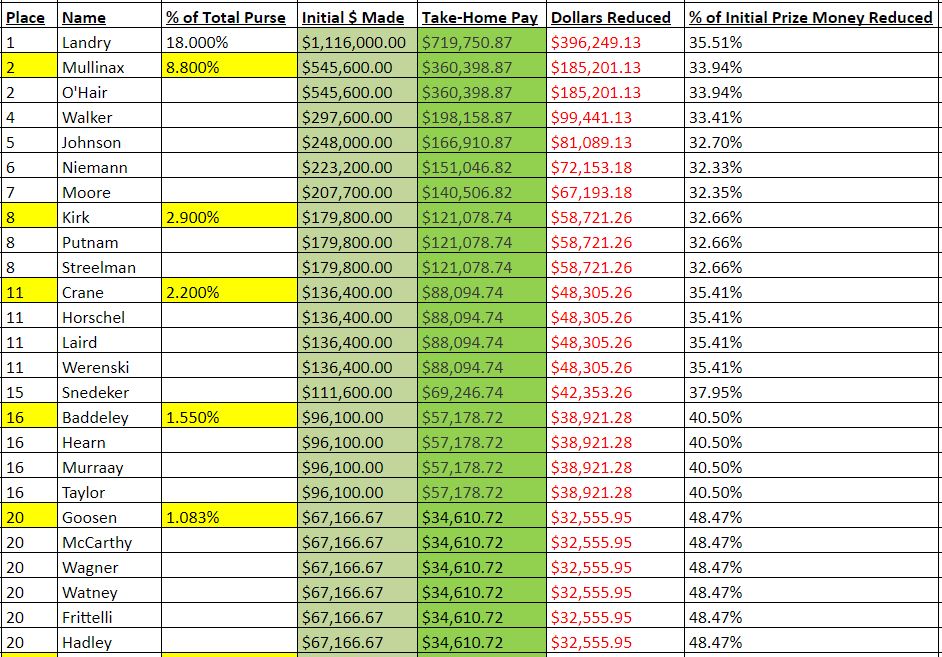

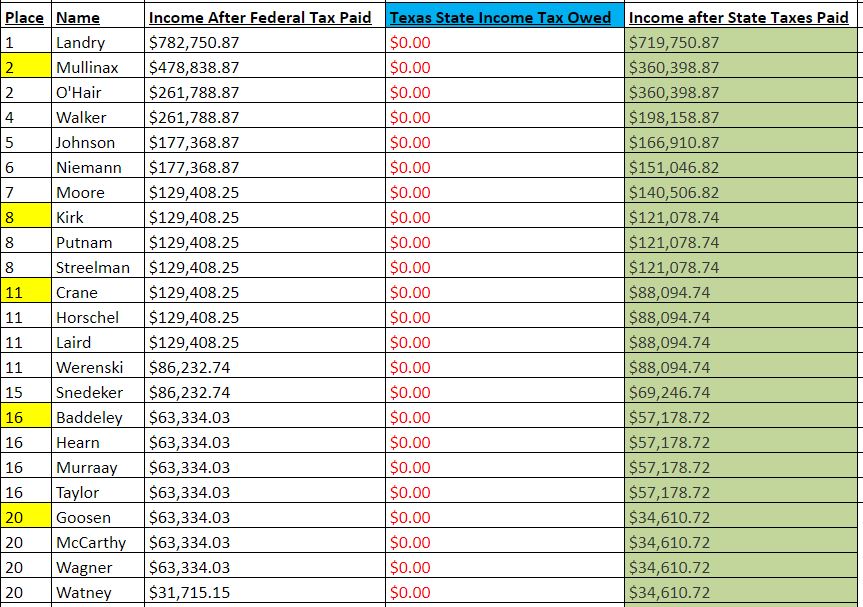

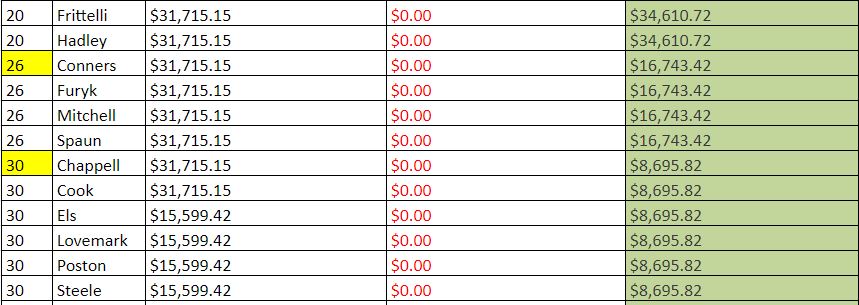

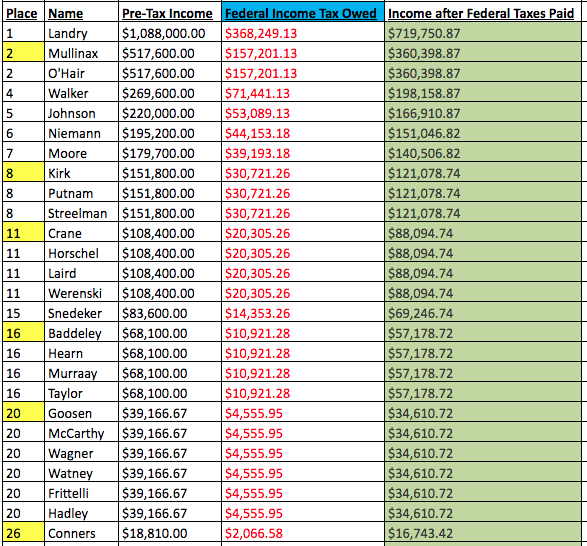

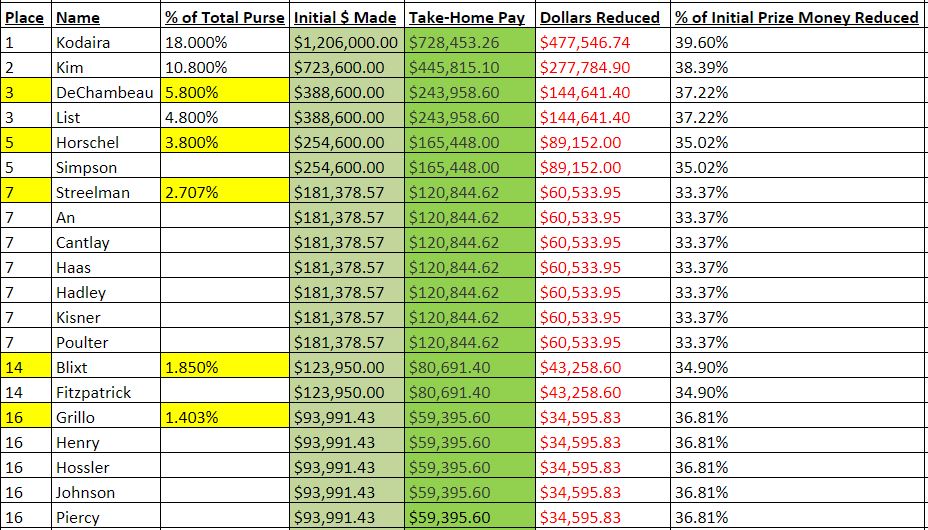

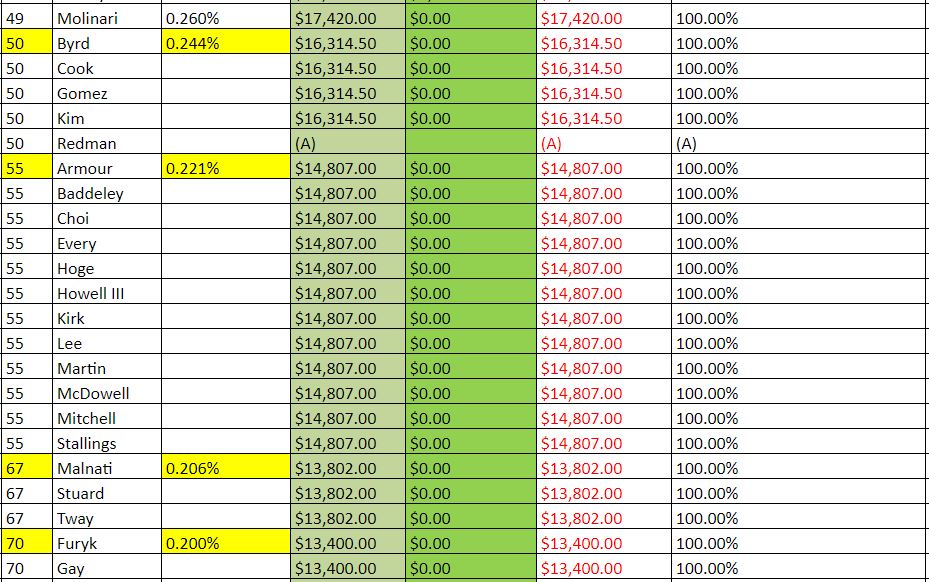

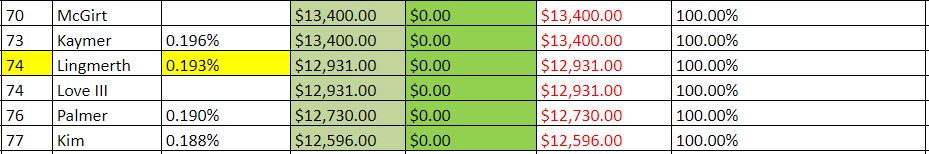

27.5% = Percentage of professional golfers whose Take Home Pay was reduced by at least $50,000

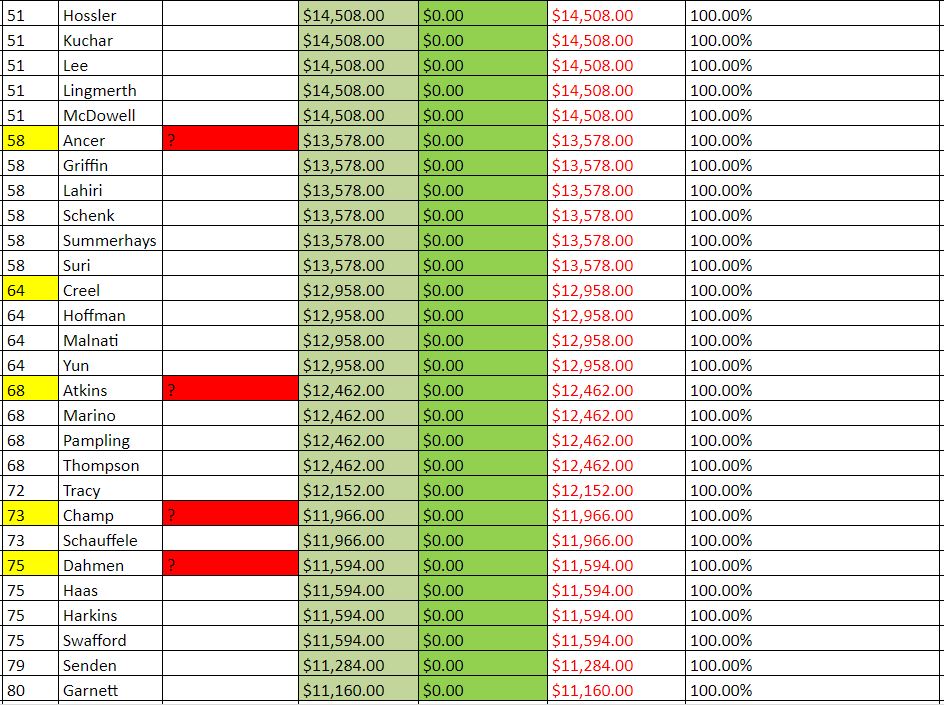

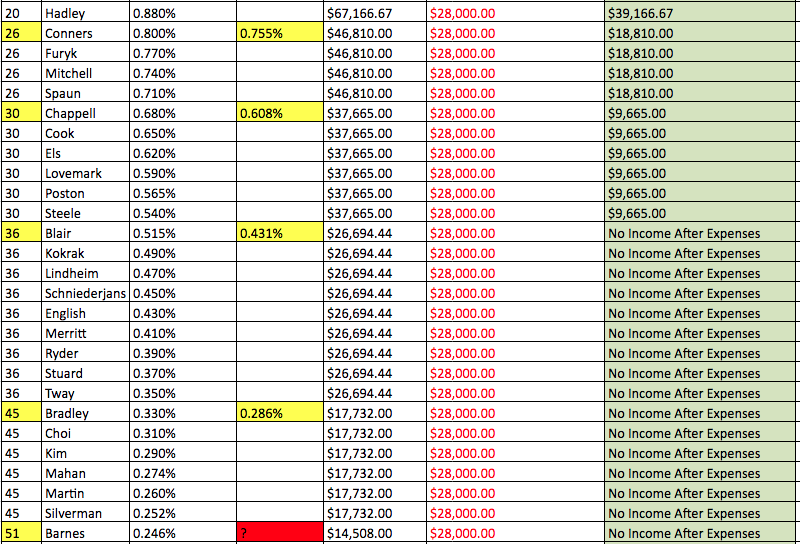

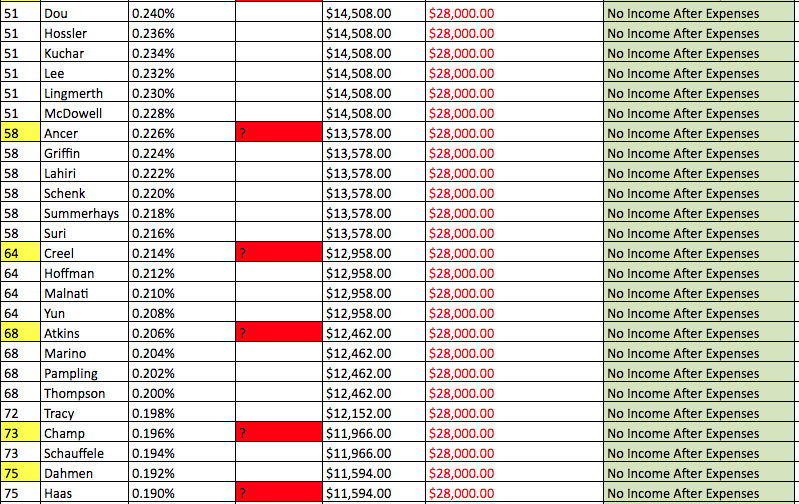

80% = Percentage of professional golfers whose Take Home Pay was below $100,000

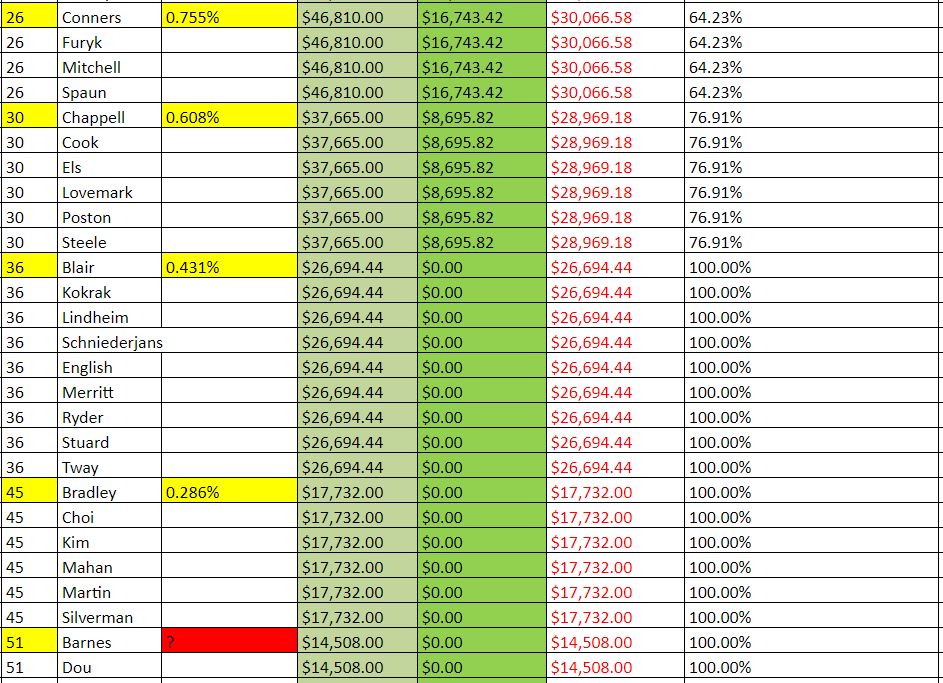

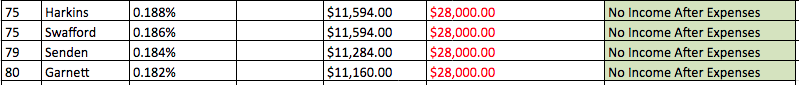

43.75% = Percentage of professional golfers who made the cut and whose Take Home Pay was $0