Congrats to Dustin Johnson on his great Dub at Crooked Stick.

Congrats to Dustin Johnson on his great Dub at Crooked Stick.

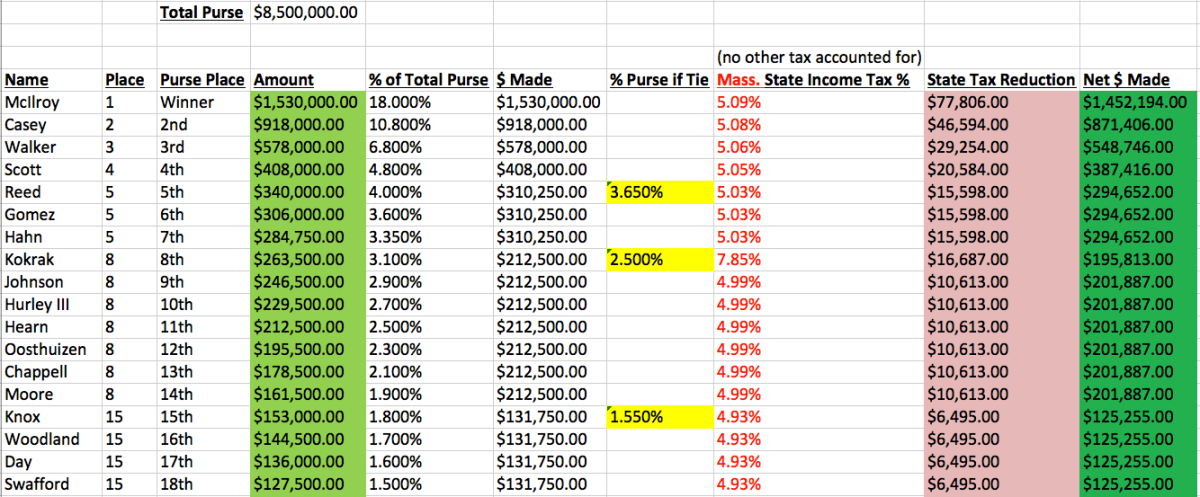

Congrats to Rory McIlroy on his impressive Monday round and Deutsche Bank Championship.

As another reminder: I am fully aware of the additional state and federal taxes along with possible business deductions associated with each round.

Last week I tried to incorporate federal taxes into the fold, but it was not accurate. I’ll keep these insights and data points relevant only to the state income tax for each week’s prize money as determined by the purse distribution percentage.

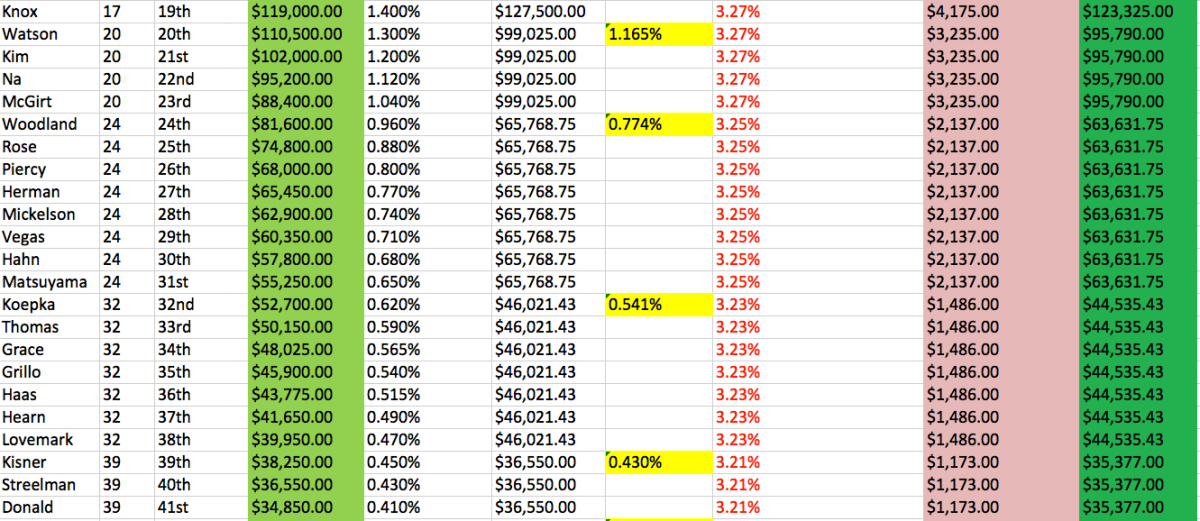

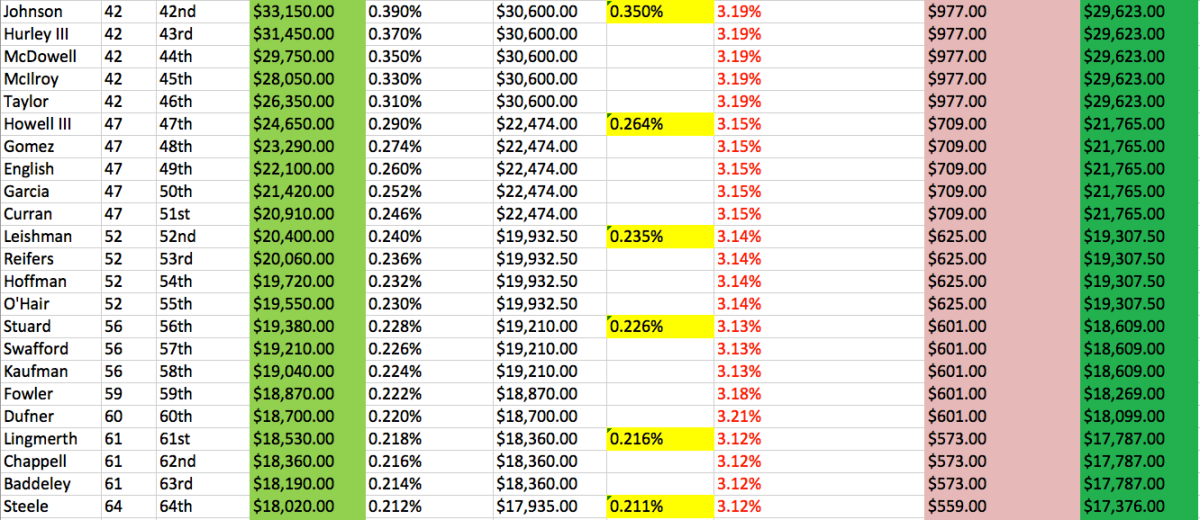

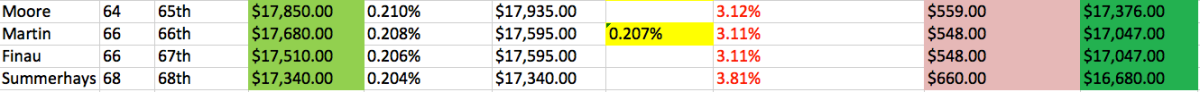

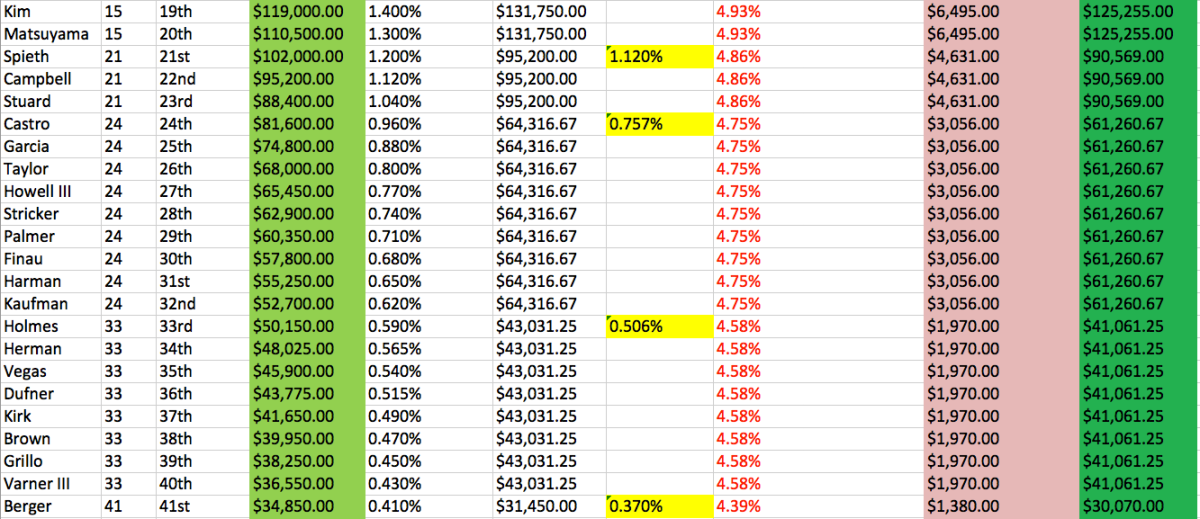

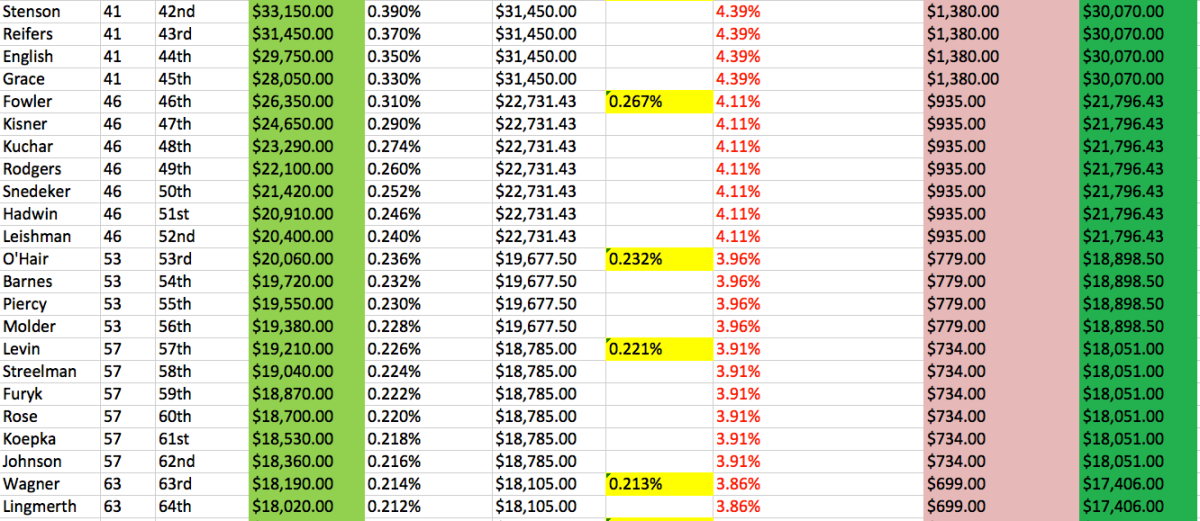

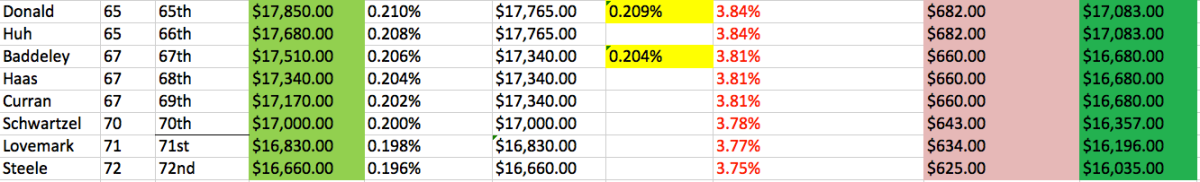

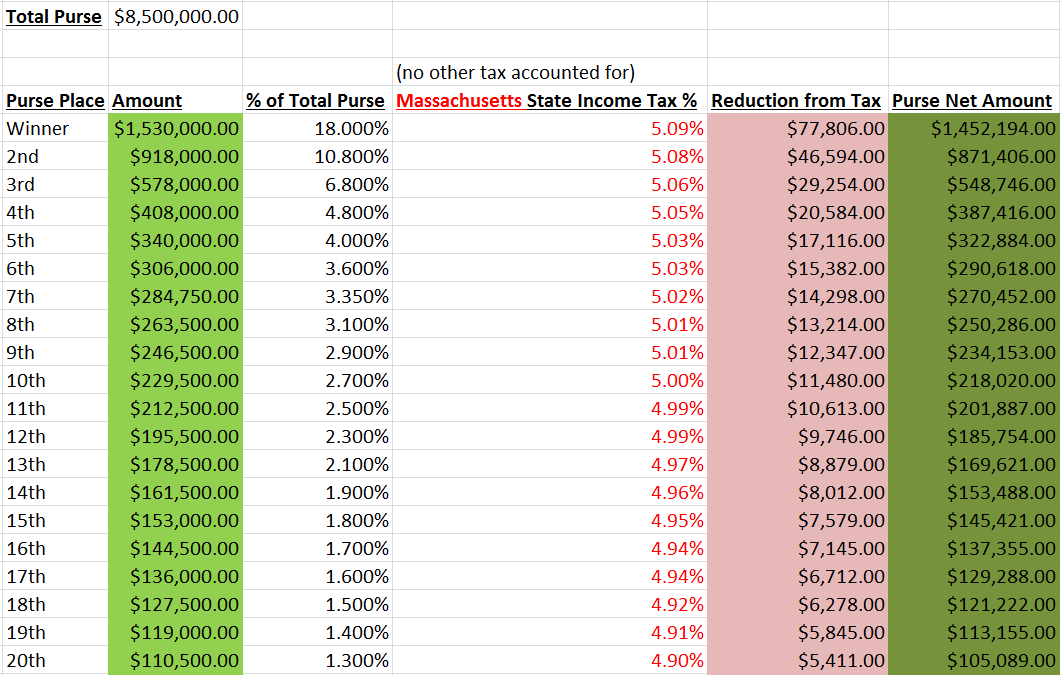

This week’s Deutsche Bank Championship takes the PGA Tour back to the Boston area.

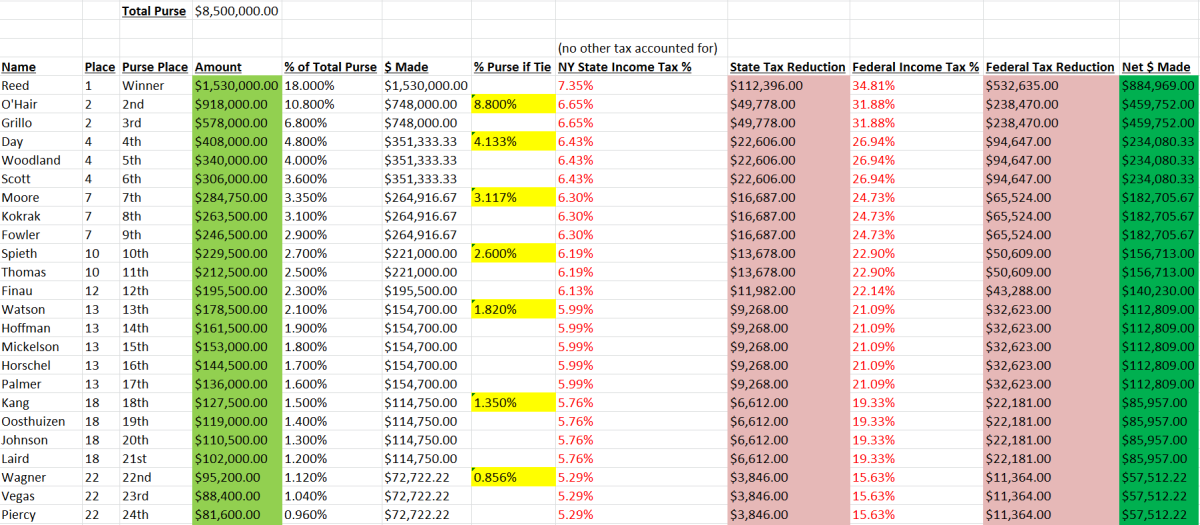

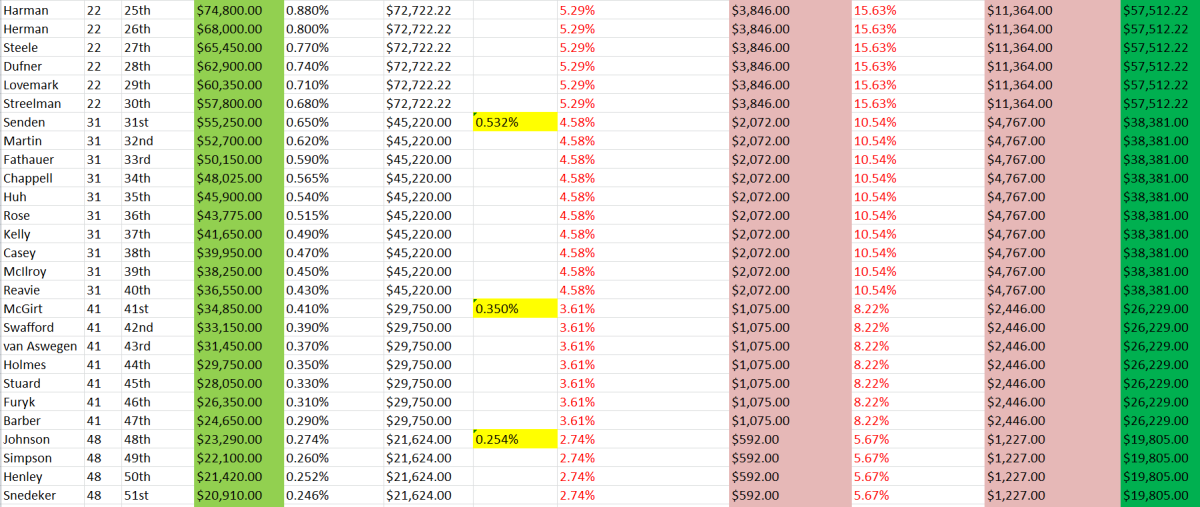

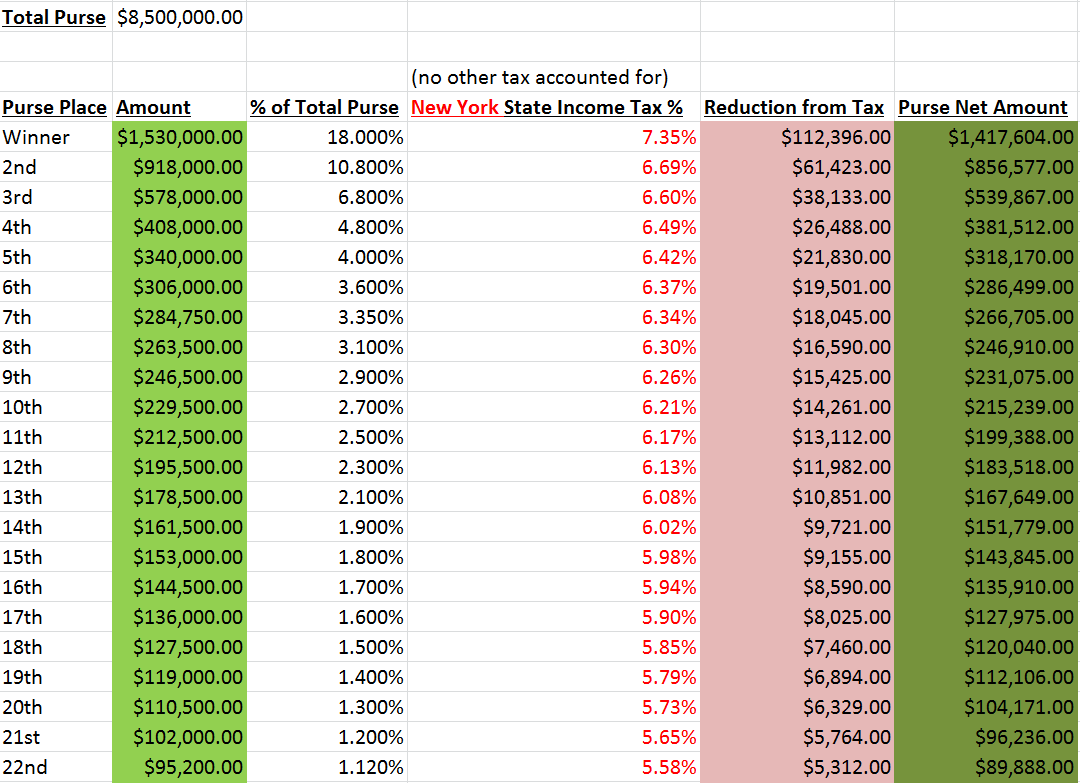

Congratulations to Patrick Reed on his victory at Bethpage Black and his 7.35% state income tax tag.

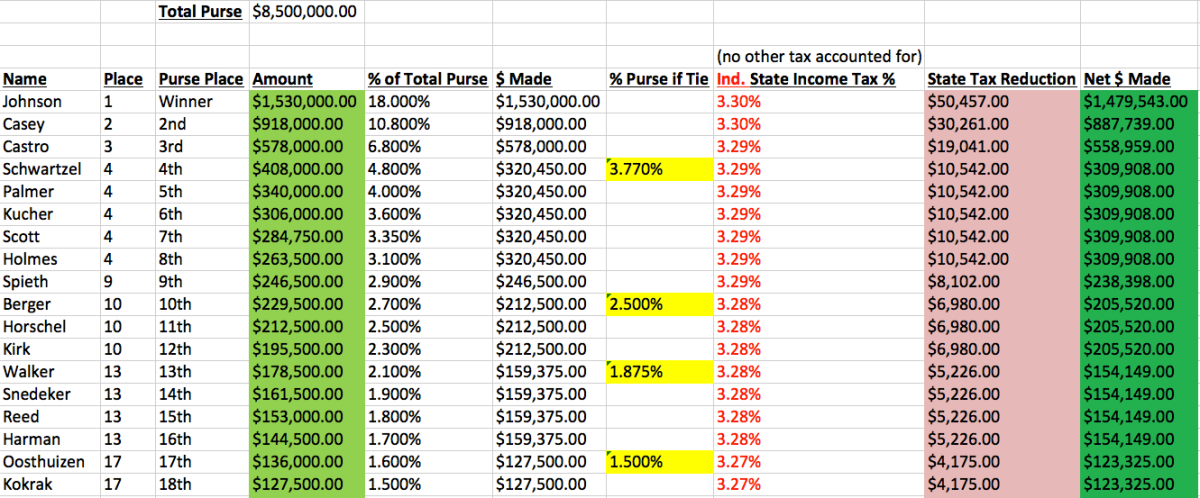

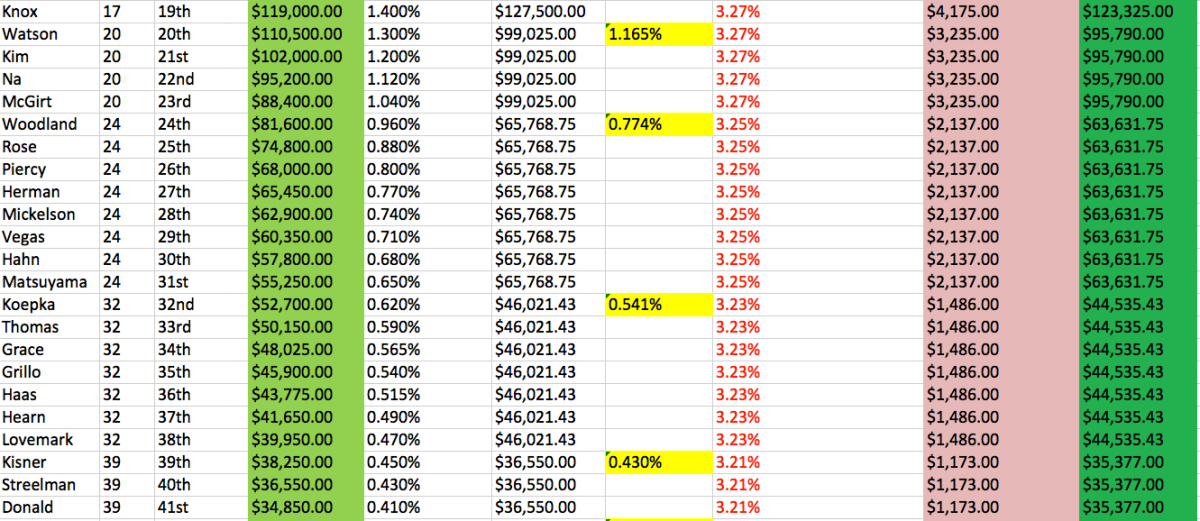

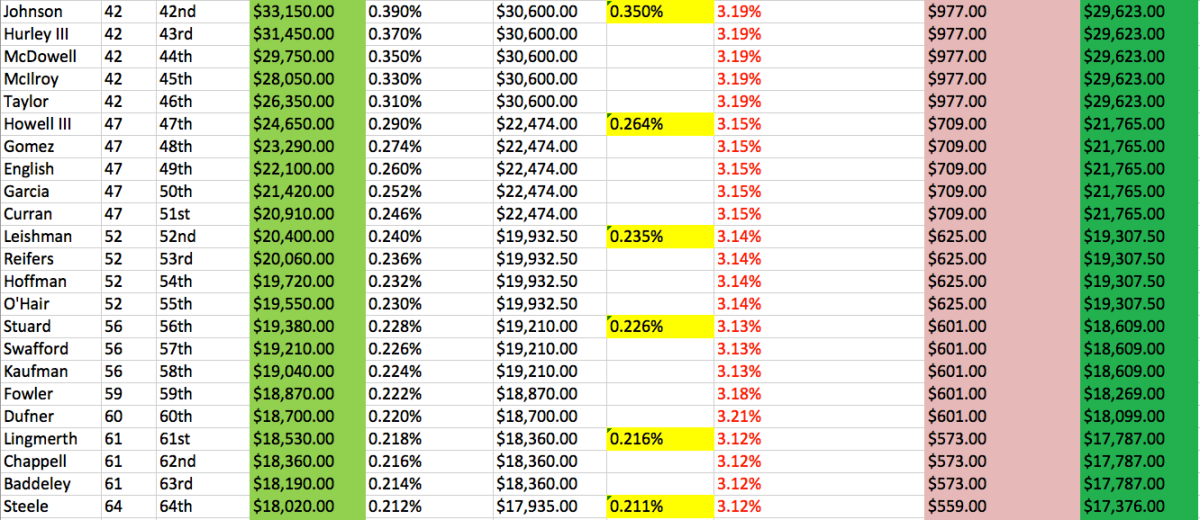

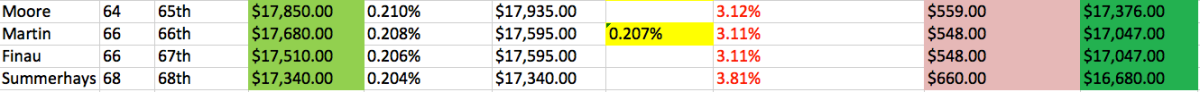

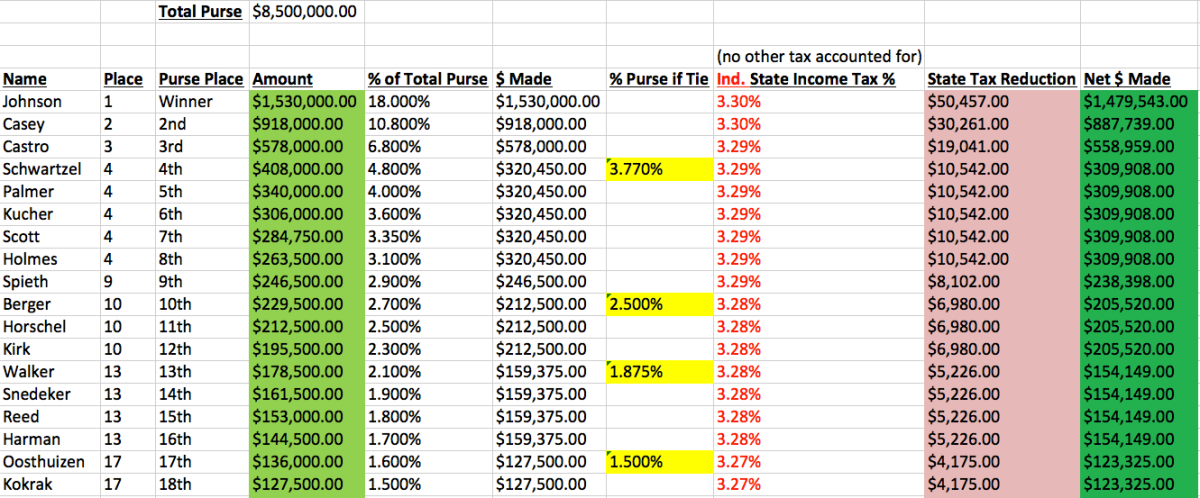

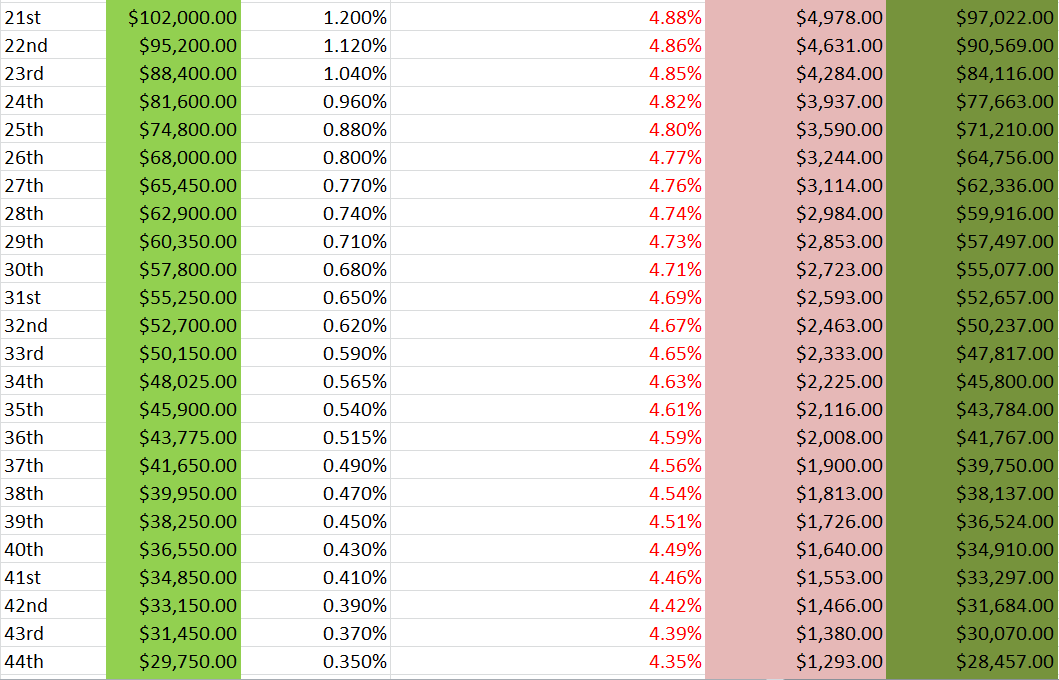

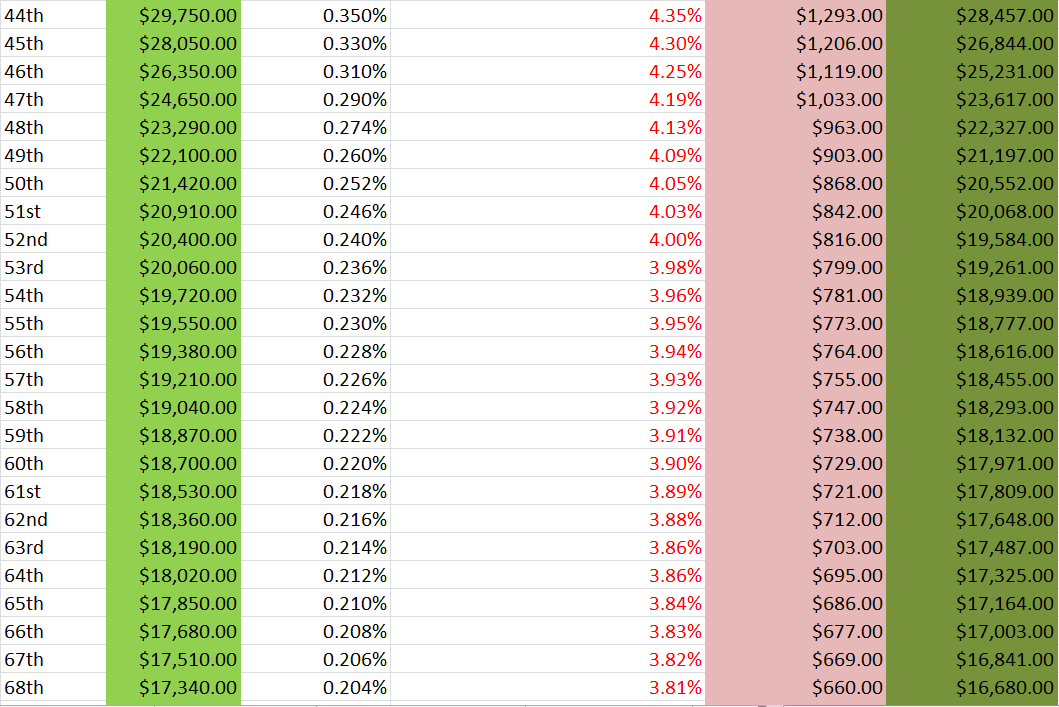

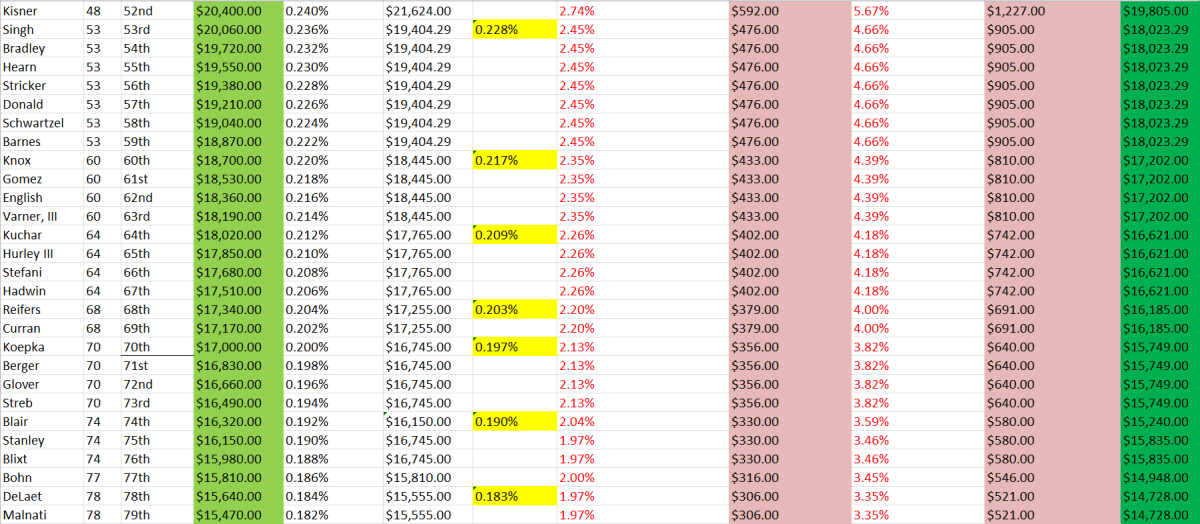

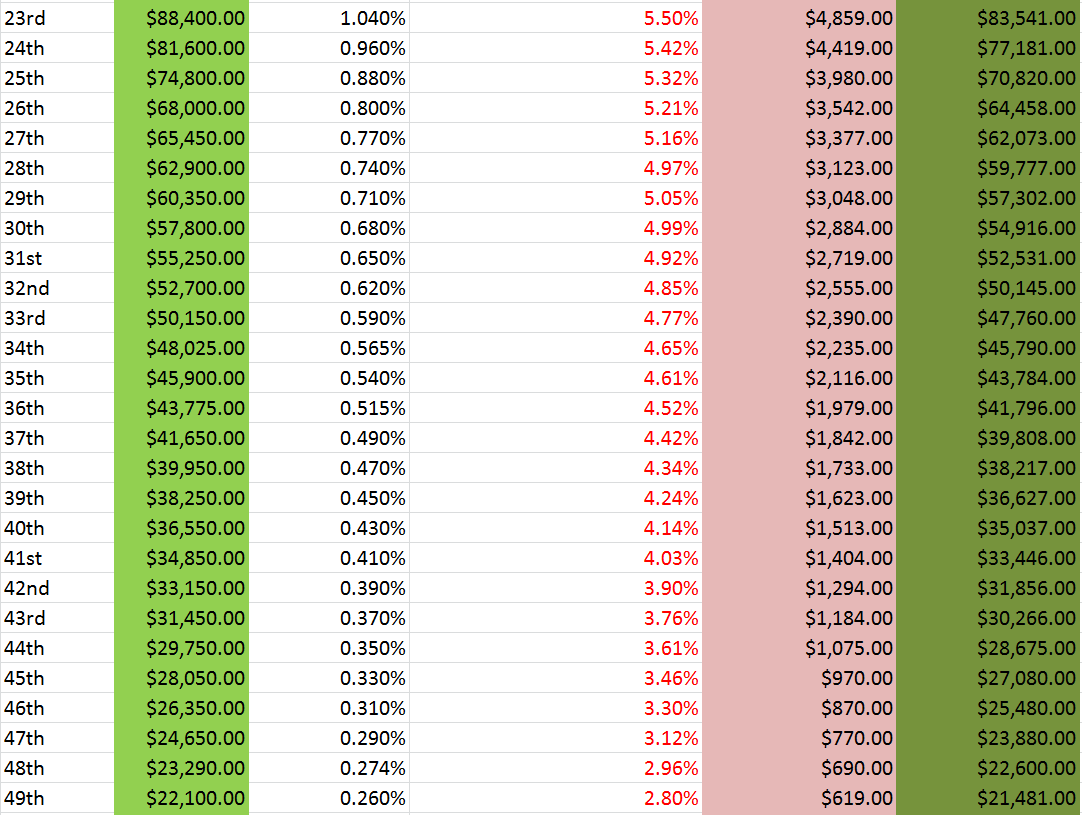

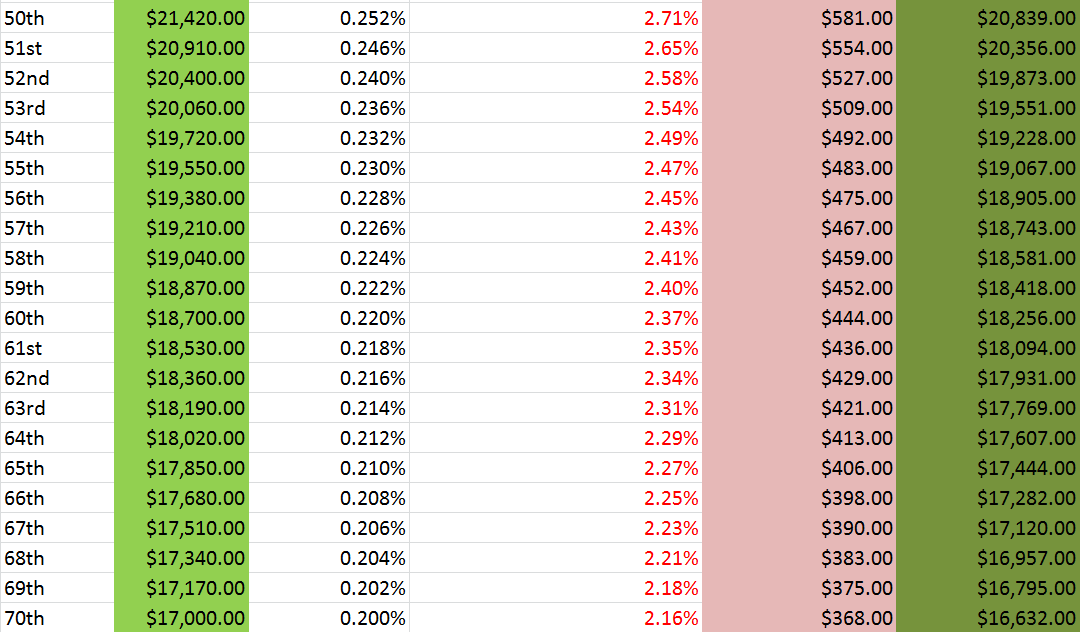

The FedEx Cup Playoffs begin today at historic Bethpage Black in Farmingdale, New York. That location and zip code have been used to calculate the state income tax associated with each finishing place for this $8.5 million purse.

I still used a standard cut to 70 players, even though I’m quite sure this cut (and all future cuts remaining for this year) and treated differently due to the arduous rules of the FedEx Cup Playoffs.

Without further ado:

I just like disclosing this – I do basic online research to try and find calculators or historical tax rate tables to give myself some sort of indicator or estimate on these rates. Usually I punch in the exact dollar amounts won and get a number. For this calculation, the dollars were bulked just into a “[insert state name]” payment. I’m not 100000% sure if it’s income tax rate only, but I have a good inclination that it does.

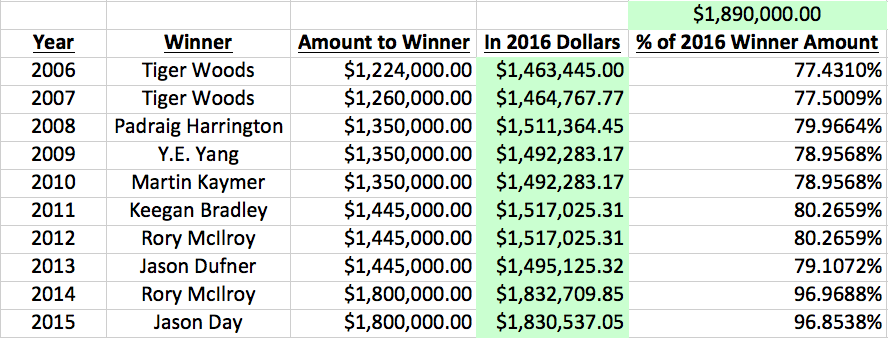

A flat 3% rate on $1.224 million made? That’s a happy Tiger Woods. While his win at Southern Hills the following year was an increase of $36,000 in prize money pre-tax, Woods only netted roughly $2,000 more in 2007 because of that great Illinois tax rate from the year before.

With Jason Dufner discussed further below, these three champs, in principle, received the exact same dollars for their PGA Championship. However, Keegan Bradley’s win at Atlanta Athletic Club only included a tax bill of $86,372 of the total $1.445 million that he won.

Regarding yesterday’s post, Jason Dufer got hosed with the dollar losing some of its value when we adjusted it for inflation to 2016.

His PGA Championship win also brought with if a 9.33% state income tax rate. It’s by far the highest among all relevant states, with a large gap between itself and the second-largest tax rate (Minnesota in 2009 at 7.77%)

I felt nostalgic this week and discovered the last 10 years of PGA Championship winners, their prize money, its adjustment for inflation to 2016, and how that prize money compares to the $1,890,000 that this year’s winner will take home Baltusrol. Here are the results:

I ran the inflation calculator three different times, and somehow despite having the same purse amount as Rory and Keegan each of the previous years, took home $21,899.99 less for his win in 2013.

You can look at it from the raw dollar amounts. You can look at it from the % compared to this year’s Winner Amount. But no matter how you slice it, the PGA Tour got a shot in the arm for the 2014 campaign.

Corporate sponsor dollars likely increased with the additional airtime that golf had for many events, but especially the majors (Golf Channel, TNT, TBS, NBCSN, etc.).

It was a tremendous 2014 for Rory in many ways. An added $355,000 on the PGA Championship paycheck can’t hurt.

It only took two years for the PGA Tour to again change the Winner Amount for this year at Baltusrol. The $90,000 addition isn’t quite as high a bump as we saw from 2013 to 2014, accounting for just a 5% bump from the 2015 amount.

Tomorrow, I’ll be back with this same historical data and include the state the tournament took place in and the income tax percentage for that state in the specific year

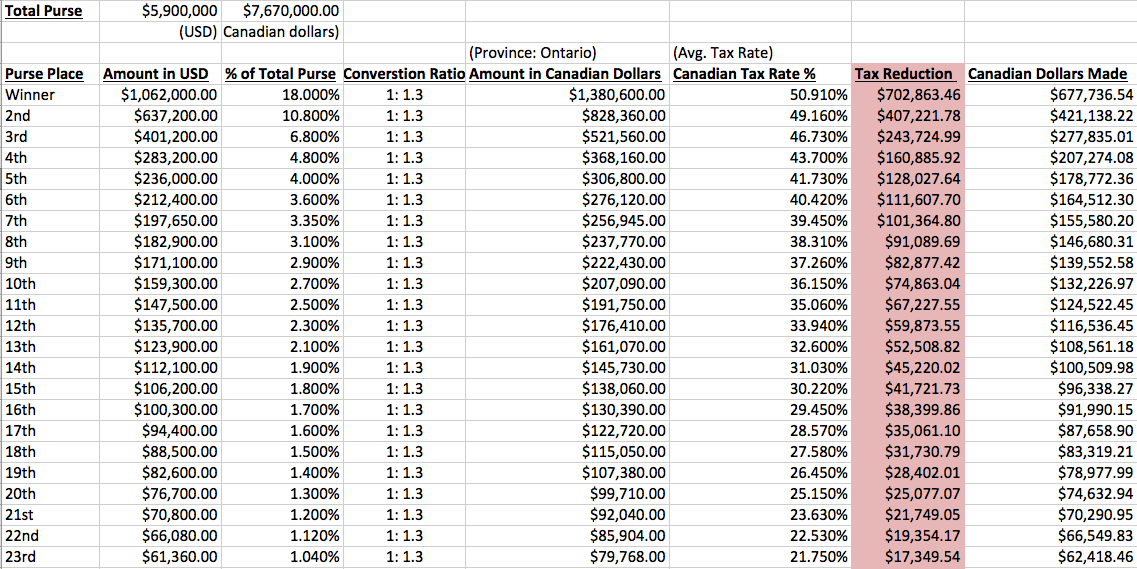

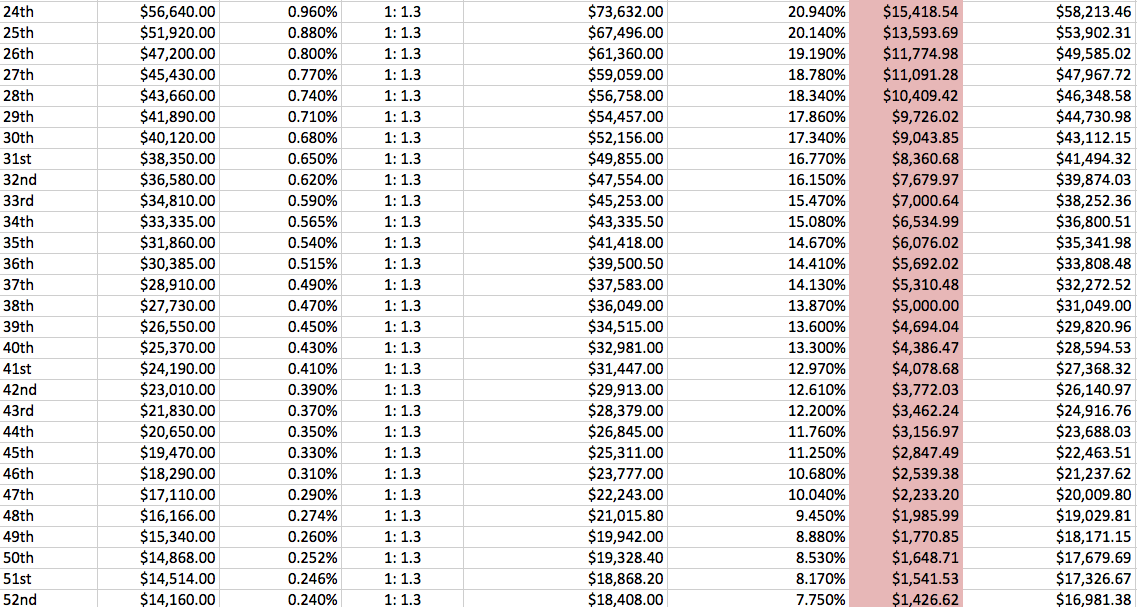

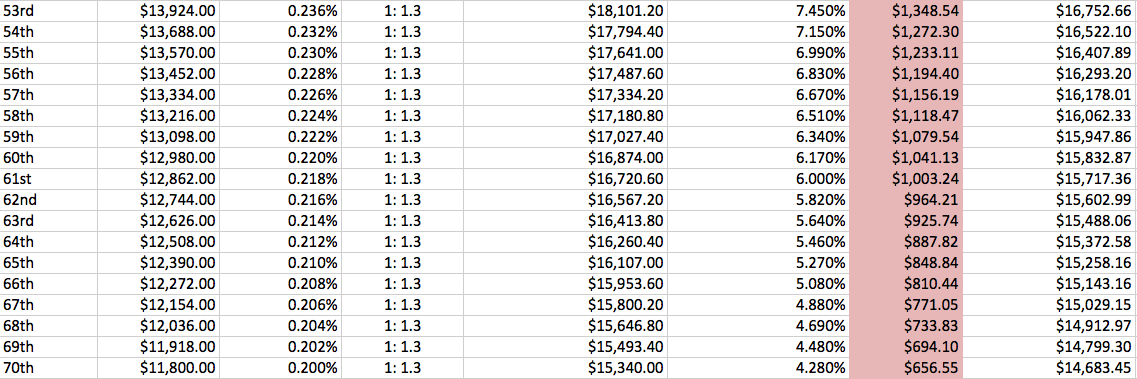

We go across the border north to Ontario and one of the PGA Tour’s oldest events. I’m still grasping this entire concept of where money is made, where it’s taxed, and when it’s taxed, and that will come with time!

But good news! At the end of the year I’ll likely total up all events and winnings of each golfer and then apply some state tax implications in the aggregate so we can all geek out super hard.

For the sake of consistency, I’ve followed a few cardinal rules I’m abiding by for this week:

Canada’s currency is also the dollar, but it does not exchange at the same rate as the United States Dollar (USD). Currently, one U.S. dollar is exchanging at 1.3 Canadian Dollars.

So if you brought a George Washington to Ontario, you would get a one-dollar gold coin back – called a loonie – and whatever other change to make the difference. I just wanted to get that loonie reference in there somehow

When I started doing some research on how Canadian taxes are calculated, it became abundantly clear that lots depends on what province your income occurs in. This week’s tournament takes place in, like it usually does, at Glen Abbey Golf Club in Ontario.

This might be the first instance where we see half of a golfer’s earnings getting taken out of pay by taxes. But remember – that’s the average tax rate, as it was the best information I could find.

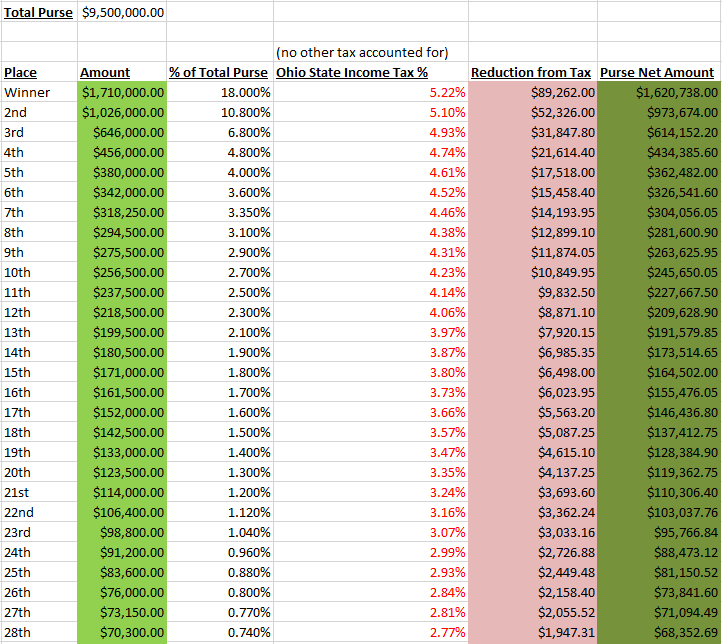

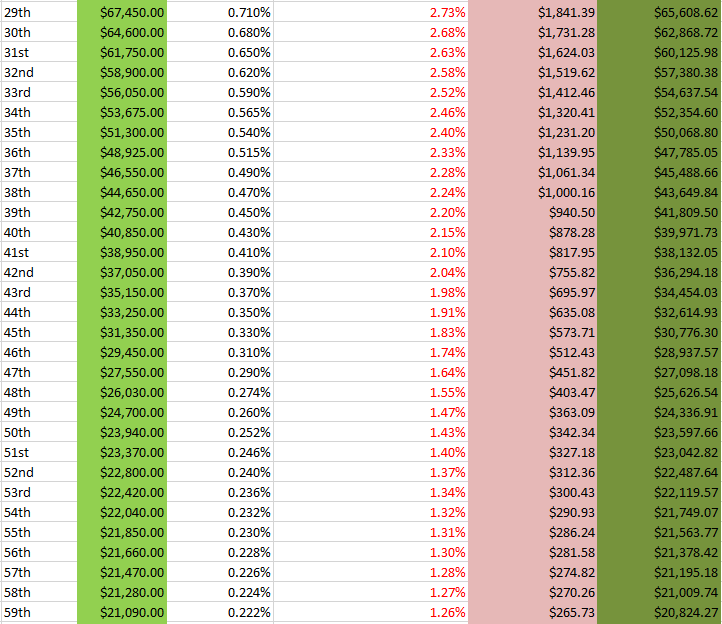

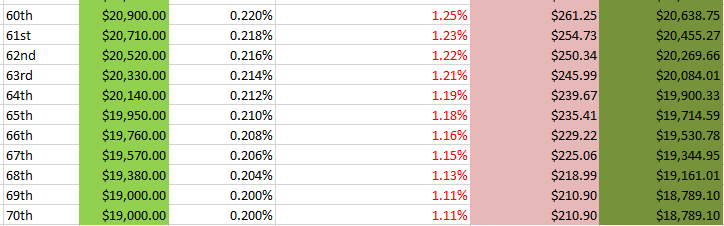

We’re back in Ohio – this time at Firestone in Akron. Same income tax rules that we saw for The Memorial. Happy 4th!