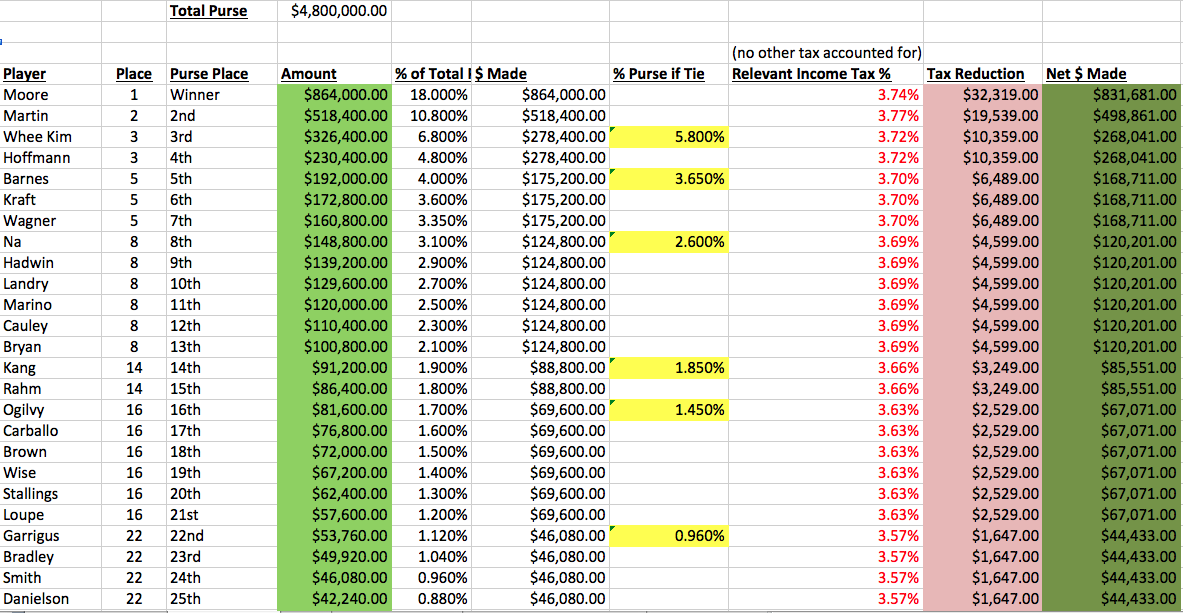

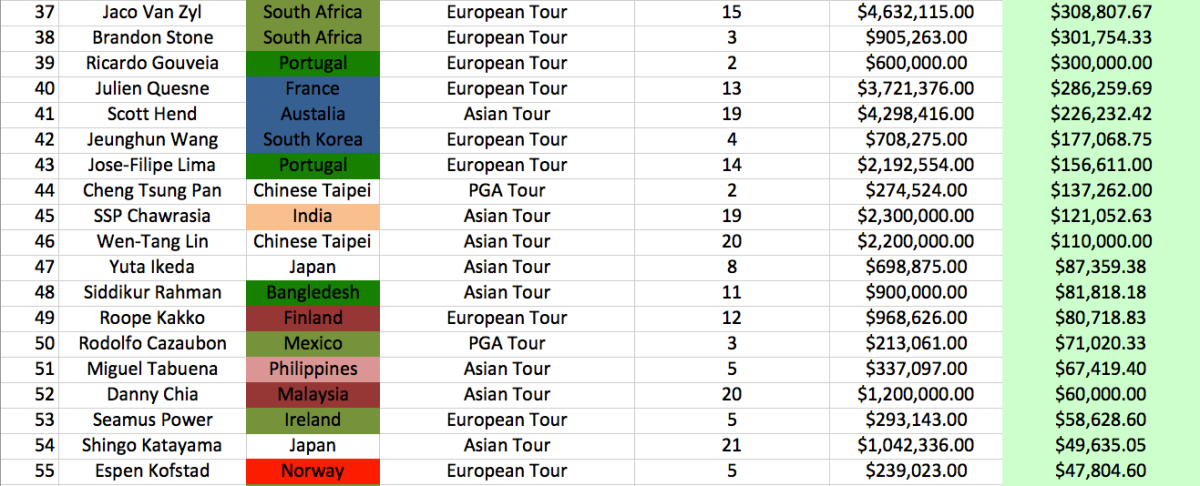

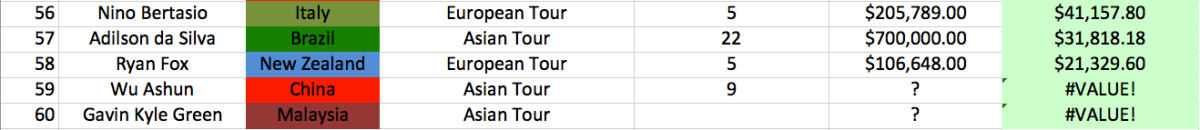

There are a plethora of ways to dissect these Olympic golfers and the dollars they’ve made throughout their careers to provide further context.

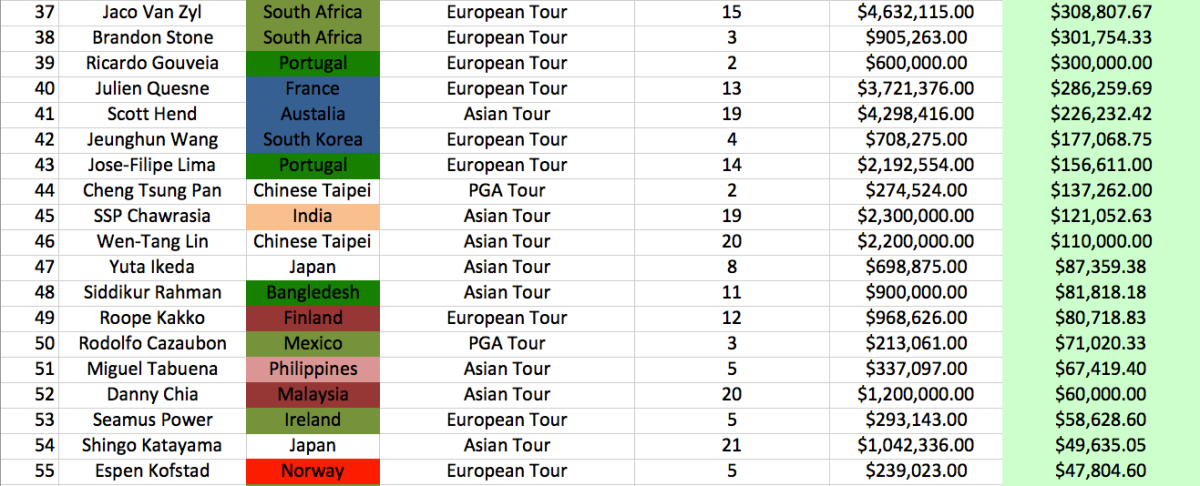

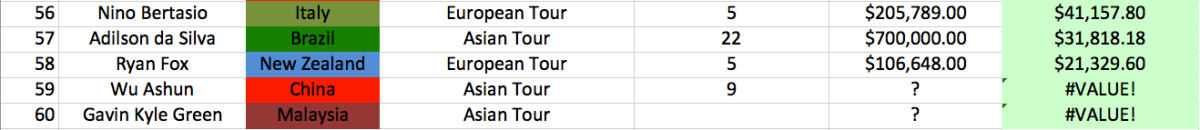

Below is a breakdown of each player, the amount of years they’ve been a Pro, their career earnings, and determining on average how much they’ve made per year as a professional.

Thoughts:

Top 2 Golfers = Americans w/ Under 10 Yrs Experience

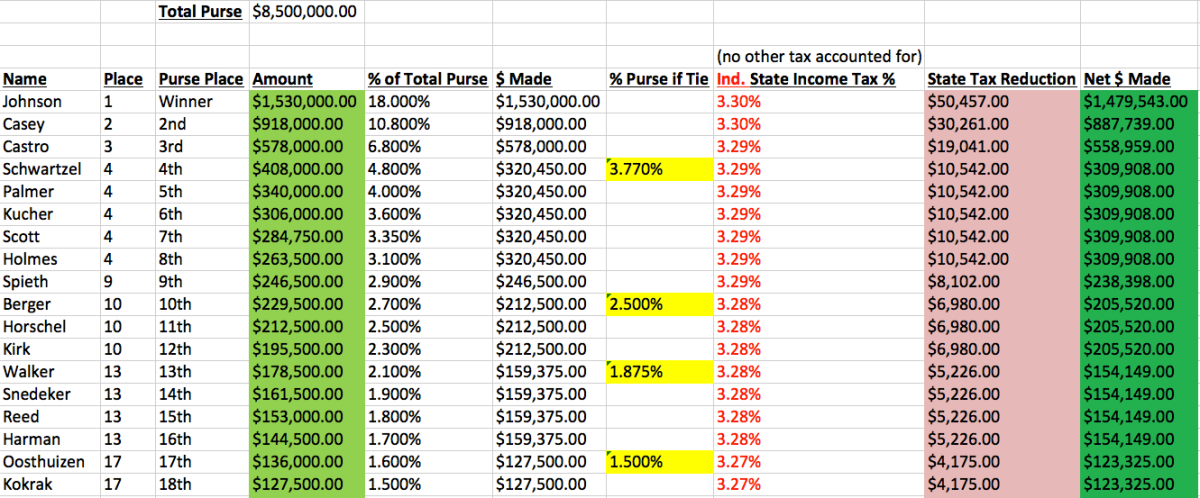

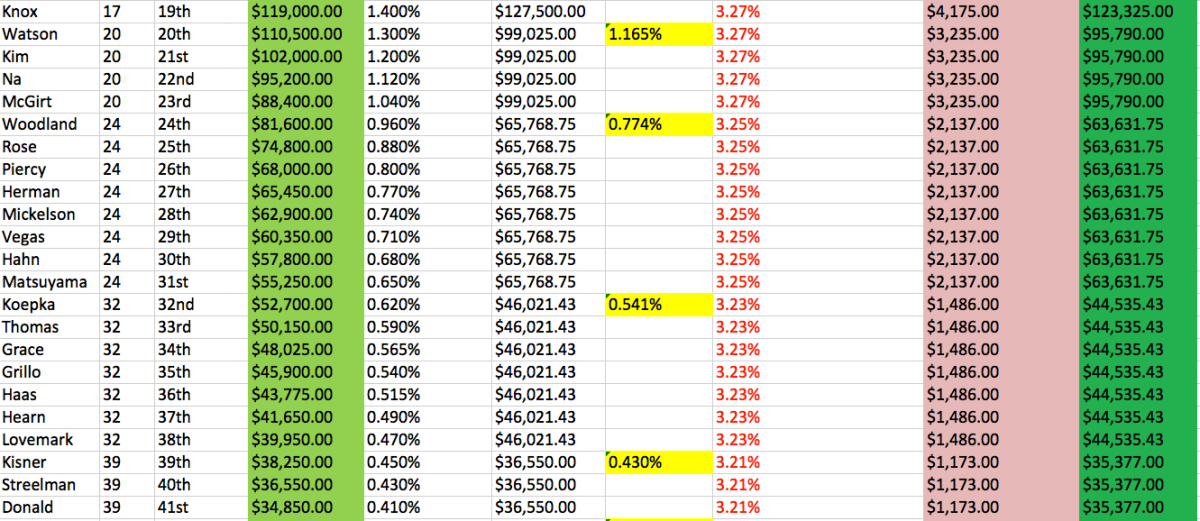

I’ll provide the necessary caveat(s) later, but Rickie Fowler and Patrick Reed have had tremendous success early in their career. In turn, that provides plenty of dollar bills in their pockets. At 27 and 26 years of age respectively, these two have consistently played at a high level.

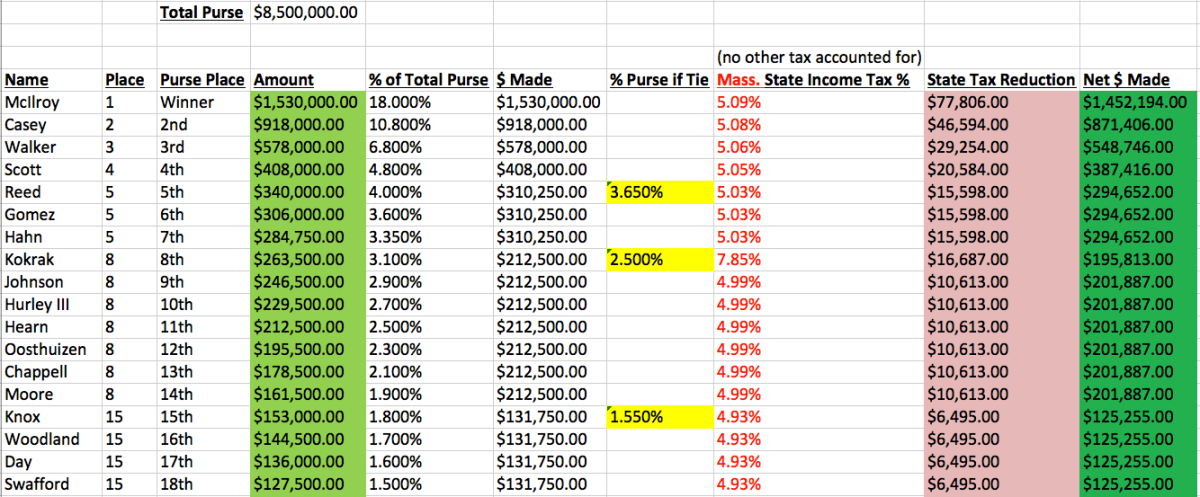

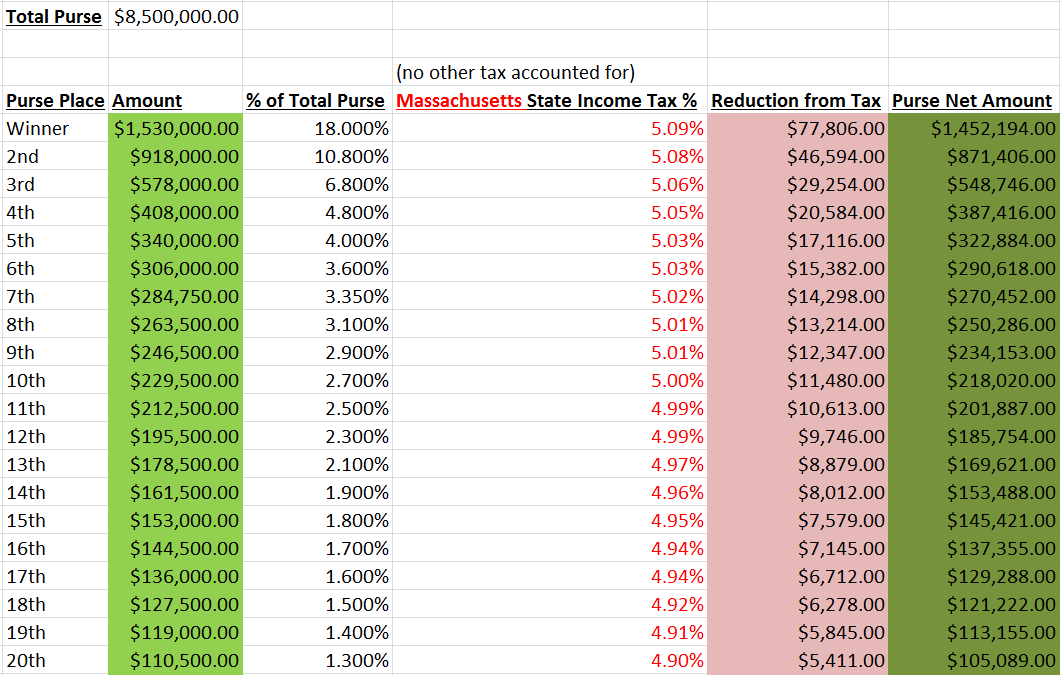

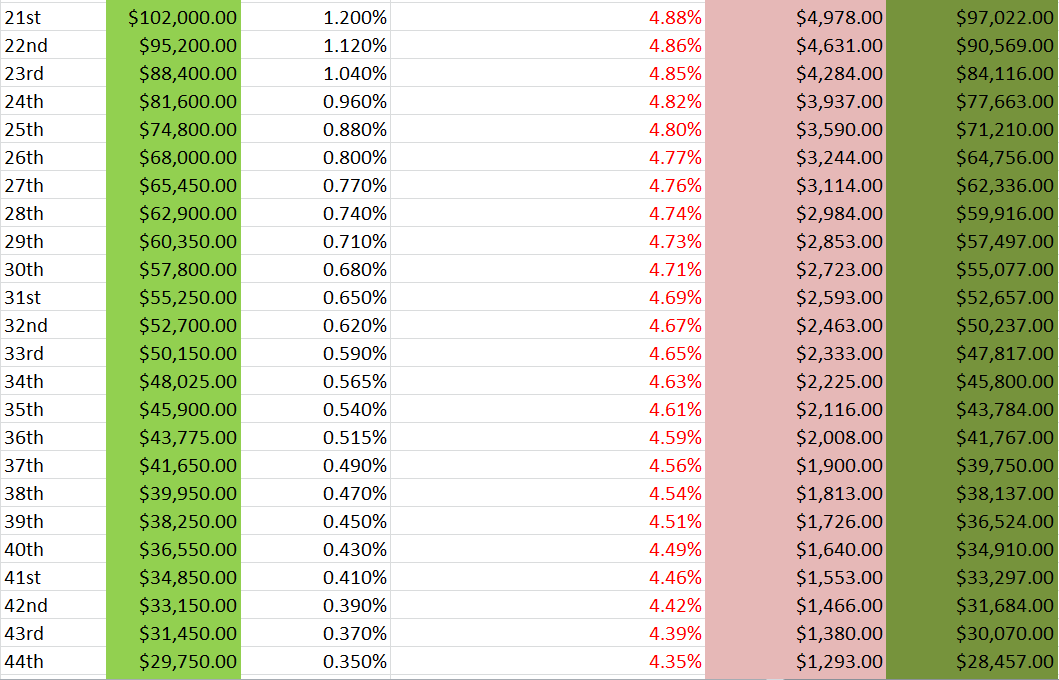

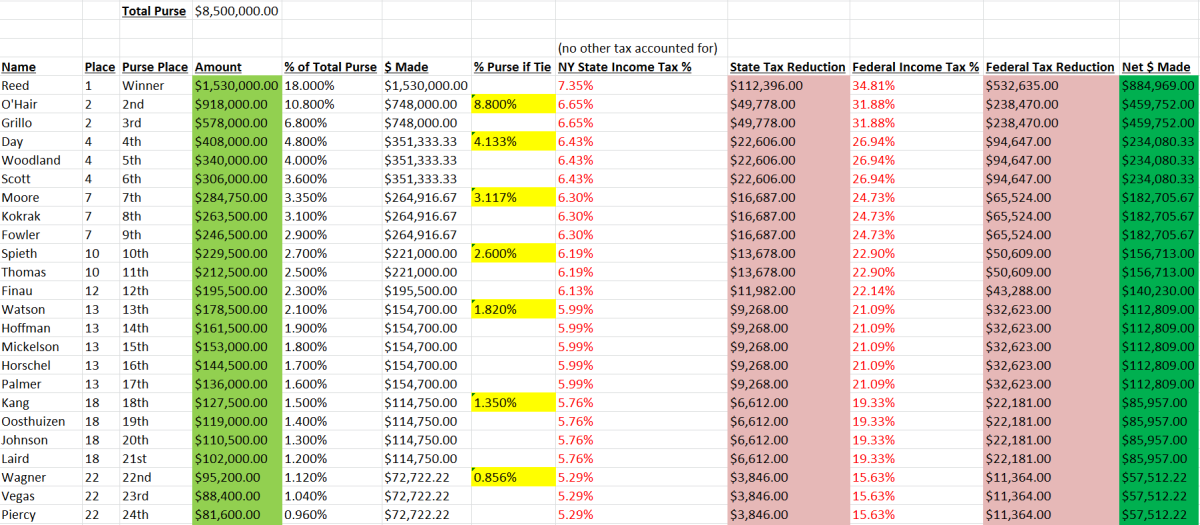

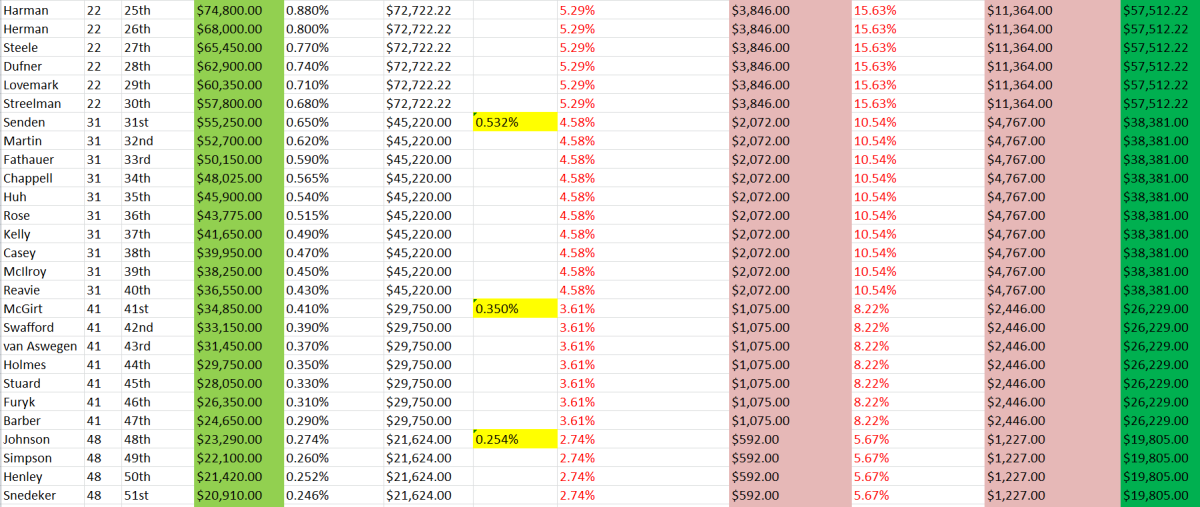

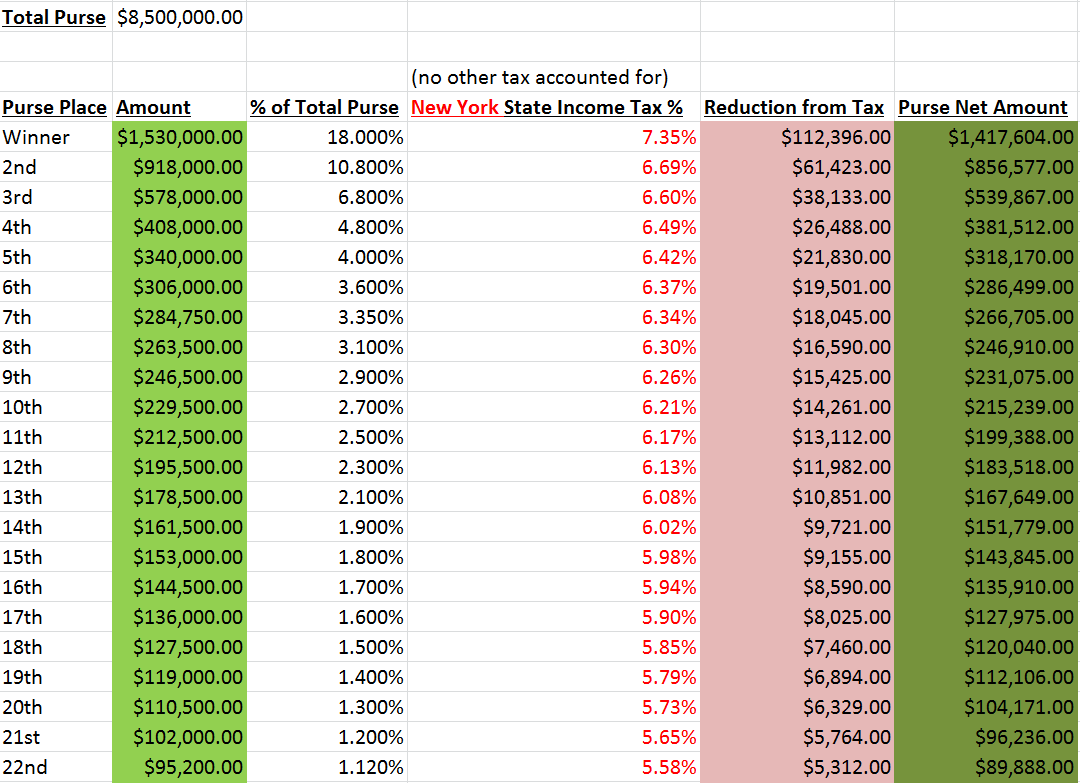

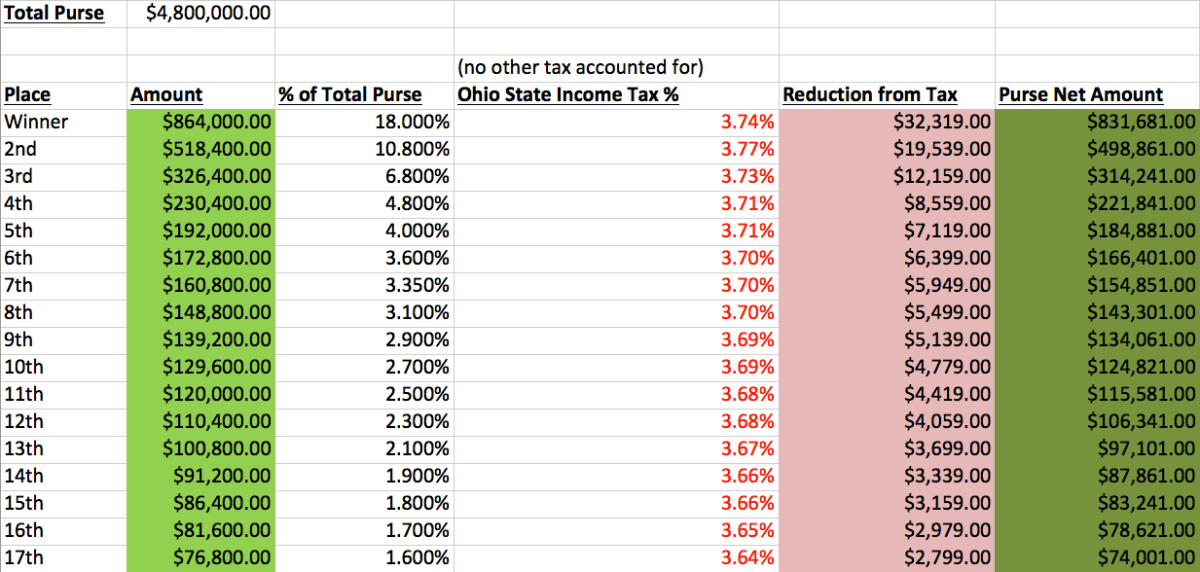

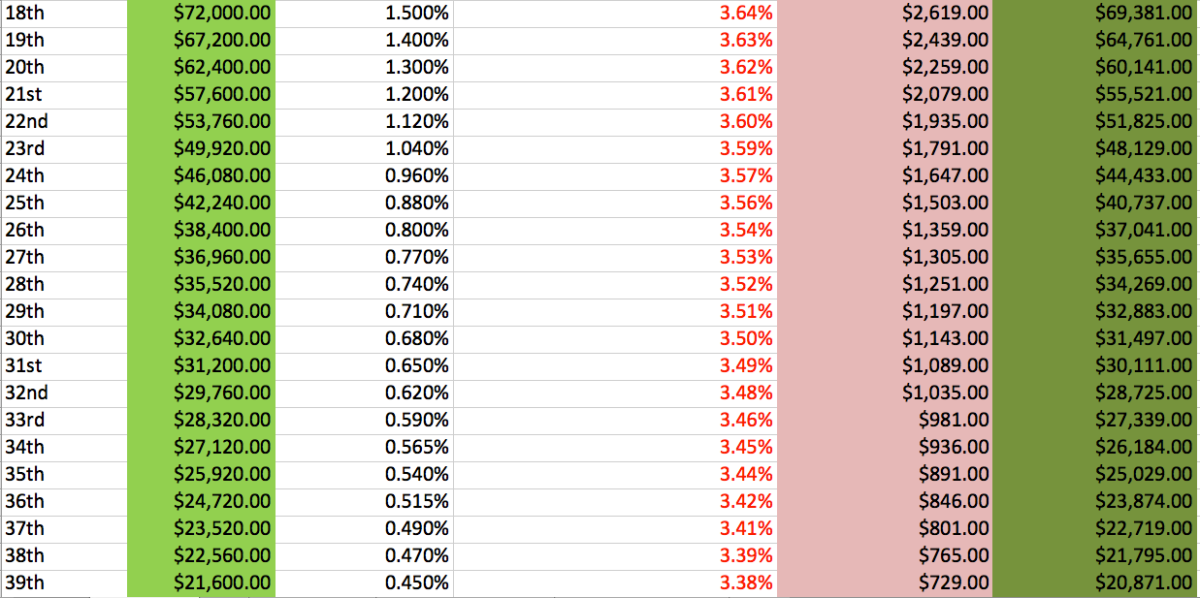

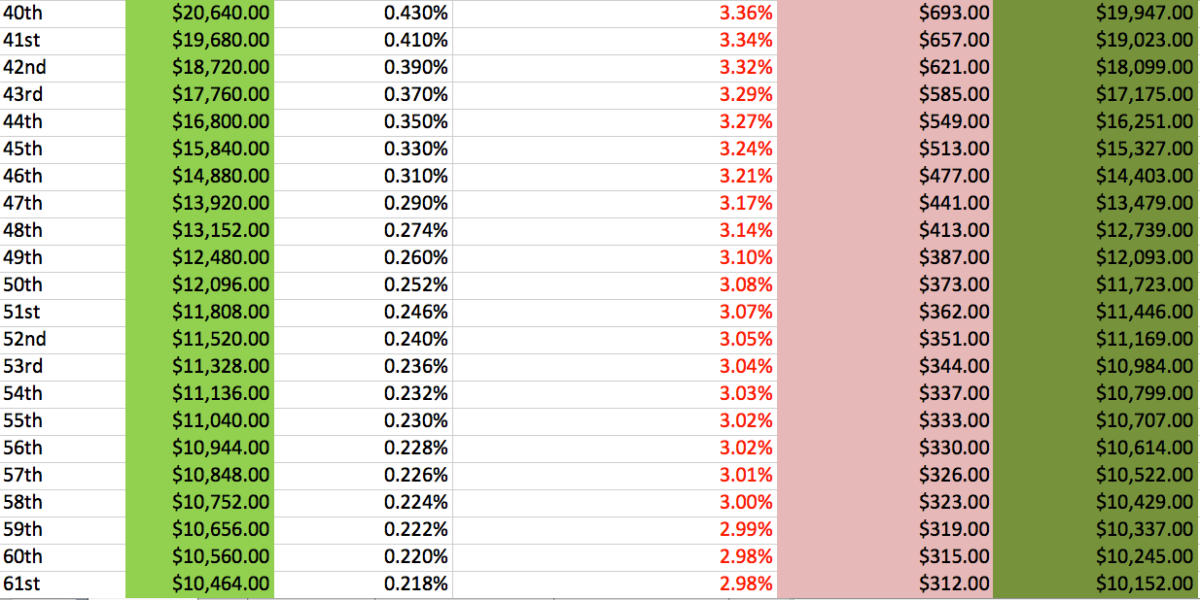

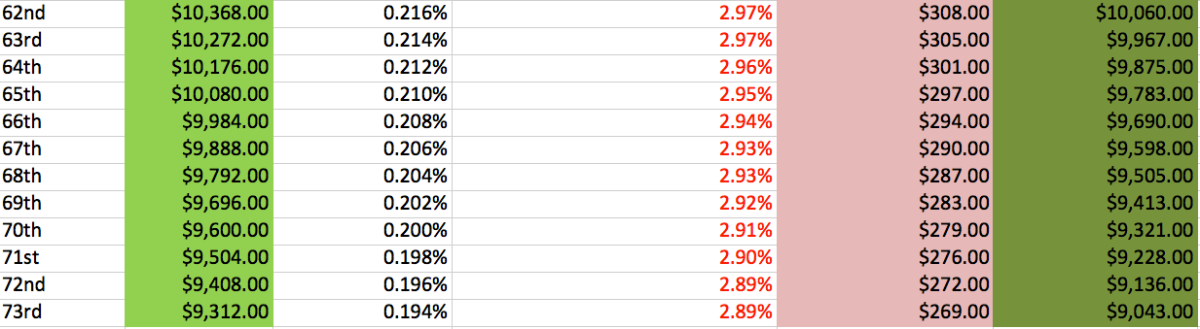

They’ve also placed very high in large purse events. Fowler won the 2015 Players Championship, bringing home $1,800,000 pre-tax. Reed won the 2014 WGC Cadillac Championship and won $1,530,000 pre-tax.

The Impact of Larger Purses Based on Time and Which Tour

And now, onto the caveats. It’s no secret that golf has become a big business in the last 5-6 years. The total purse for the U.S. Open was $10,000,000 and $10,500,000 for the PGA Championship. There are loads of money to be made playing professional golf.

Furthermore, a majority of that large capital is housed within the PGA Tour. The PGA and/or USGA has two major revenue streams that keep growing: corporate sponsorship dollars that underwrite the large events, and television rights that have continued to skyrocket and put more capital into a golf association’s coffers.

The PGA Tour has not been shy about trying to increase its bottom line. It will not host an event at Trump Doral next year, not for political purposes but because of the dollars available from a corporate sponsor to take the event to Mexico City.

While the PGA Tour is the cream of the crop in terms of total purse amounts and its quality of players, there seems to be a trickle down effect to other tours.

The European Tour has two players participating the Olympics that have been playing for less than 10 years but are in the Top 15 in average dollars made per year.

Ranked 6th on my list, Matteo Manassero has been playing golf professionally for 6 years and bringing in a cool $1.3 million per year on average. Thorbjorn Olesen has also had major success in his 8 years predominantly on the European Tour.

Playing Golf for Your Career is very Lucrative

I’d say that 27 years in one career is a large enough sample size to see how one can fare playing professional golf.

Like most professional athletes, the sample size of those playing golf for a living compared to the world population is microscopic.

Unlike most professional sports, professional golfers do not receive guaranteed money (outside of non-competition money like sponsorships and advertisements). They must compete every week and earn each dollar based on their performance. A baseball player can go 0-5 with 4 strikeouts, and he’ll still be paid regardless of his performance. A professional golfer shoots 9 over and misses the cut, and he heads home with $0 in earnings.

That’s why Alex Cejka’s is a great illustration that being a professional golfer kicks butt. 27 years playing and a shade under $11 million total made on Tour. That comes to about $400,000 pre-tax dollars made each year.

That’s a nice way to live.