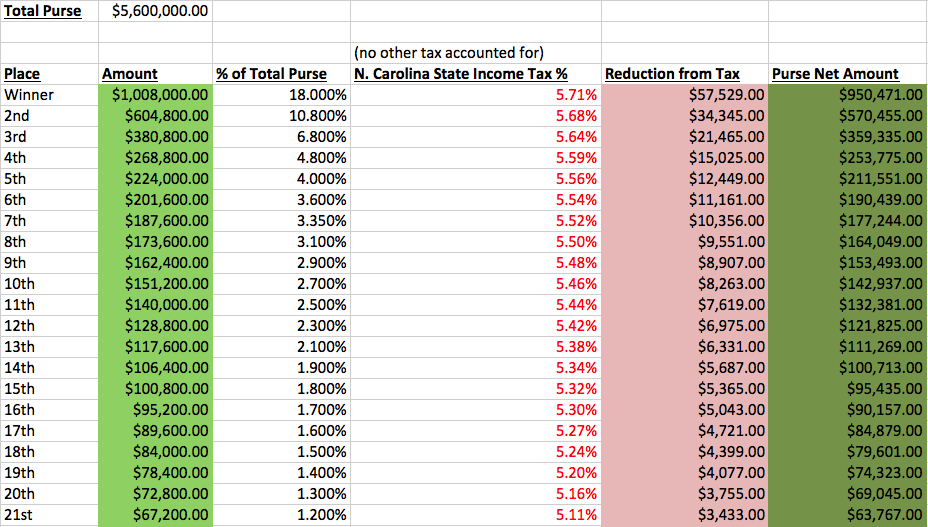

# of Players in Field: 156

Amount to Winner (After Taxes): $950,471.00

Purse Breakdown if Exactly Half the Field (73) Makes the Cut:

Thoughts:

Those Tax Rates – Great Scott!

I watched Back to the Future for the fist time last night. I thought it was not funny and pretty dumb. Maybe it deserves a second viewing.

These North Carolina income tax rates are not funny as well. Golfers finishing first through 23rd this weekend are going to get hit with a tax bill north of 5%.

For the sake of recency, if we were to compare the Wyndham Championship to the John Deere Classic, there are some eye-popping differences.

First, the John Deere Classic’s total purse is 15% less than the Wyndham. While $800,000 more is available this weekend, top 3 finishers this week are only netting a smidge more than the guys who did great last week in Illinois. If we eliminate the Winner’s share, mostly because the percentage he takes home relative to the entire purse is so much larger than every other golfer, we see how much these income taxes are affecting take-home pay:

- 2nd place: $71,594 difference

- 3rd place: $45,094 difference

- 4th place: $31, 934 difference

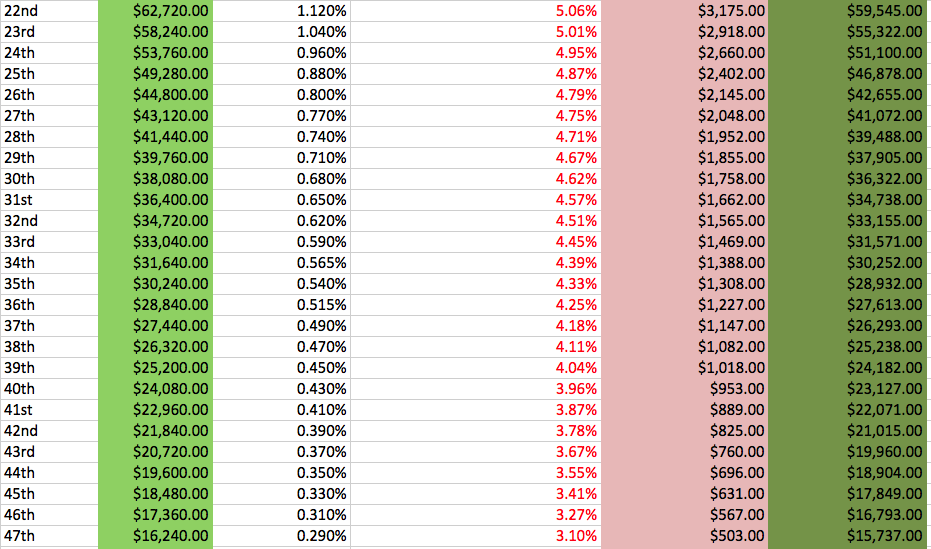

A Precipitous Tax Rate Dip below $25k

With the natural tax regression occurring throughout the data, the tax rates start to plunge when a golfer’s prize money nears $25,000. We see drops of 8, 9, 9, 11, 12, and 14 percentage points respectfully for the golfers that will finish between 39th and 45th.